From Rich Miller over at DataCenterKnowledge comes this weekend’s entertainment. How to best visualize the risk of catastrophic damage to the servers and other equipment you are colocating in a datacenter? Hollywood has taught us so many ways to depict utter devastation, but there’s nothing quite like the do-it-yourself nature of YouTube: [Read more →]

Competitive Telecom Trends: EBITDA Minus Capex

November 20th, 2009

Continuing with this week’s post-earning season analysis of competitive telecom companies, we look at EBITDA minus Capex, normalized by Revenue. In other words, something that might be called an adjusted operating cash flow margin. What we really want is to subtract maintenance capex, which would give us a number that the bond guys weigh heavily because it measures how much cash the business could generate if it weren’t re-investing the surplus for growth. But that’s a number we rarely if ever have, so we will make do with what we have and see what we can see: [Read more →]

XO Charges Into the Inland Empire

November 19th, 2009

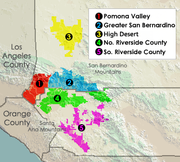

xoho has expanded operations across the ‘Inland Empire’ region of southern California. I must admit, being from the east coast I had to look that one up on Wikipedia. The inland empire is the area headed by San Bernadino and Riverside, amongst others. It’s a fast growing area of course, which is surely one reason why XO has focused resources there. [Read more →]

xoho has expanded operations across the ‘Inland Empire’ region of southern California. I must admit, being from the east coast I had to look that one up on Wikipedia. The inland empire is the area headed by San Bernadino and Riverside, amongst others. It’s a fast growing area of course, which is surely one reason why XO has focused resources there. [Read more →]

Plans for 40G? 100G? Packet Optical?

November 19th, 2009

We get a lot of PR about 40G and 100G developments and the other next generation technologies like packet-optical systems, but PR does tend to be rather one-sided by its very nature. What would really help is some independent data to give us a more realistic idea of how badly the industry needs these technologies, when they expect to get it, and how they expect to deploy it. As it happens, Infonetics is currently running a survey looking into actual carrier plans for deploying such technologies. Qualified participants will get [Read more →]

Capex Trends Amongst Competitive Telecoms

November 18th, 2009

Yesterday in a comment on my EBITDA Margin Trends post, Raul suggested that I also plot EBITDA less Capital Expenditures for telecoms. I will do so, but along the way I thought it might be interesting to look just at capex trends themselves across the sector. Now it is no secret that fiber-heavy companies spend more capex as a percentage of revenue, but I still found it interesting to see them side by side: [Read more →]

TDC Buys Fiber Network

November 18th, 2009

The Danish telecommunications company TDC has bought itself some more fiber. The company has agreed to acquire the network assembled by Dong Energy for about US$85M. What a name this company has, I had to be rather careful writing the title to this post. Dong was rumored to be looking for a buyer in the late Spring, looks like they finally found one. The purchase will go nicely with TDC’s combined wireless and wireline networks, and brings them [Read more →]

NTT, AT&T Add Cloud Offerings

November 17th, 2009

Telecommunications companies are definitely pushing deeper into the nascent cloud computing market. Today it was ntt and t who added new cloud-derived products for the enterprise. As with most new technologies, the cloud is made up of 10% dynamic, revolutionary concept and 90% marketing fluff by people trying to ride the buzzwords to riches. Nevertheless, we are now seeing real attempts to turn the cloud into actual services people buy, sell, and most of all use. [Read more →]

EBITDA Margin Trends for Competitive Fiber Networks 11/2009

November 17th, 2009

Since earnings season has officially ended, it is time for my quarterly look at EBITDA margin trends across the whole range of fiber networking companies. I don’t use the word CLECs because some of these companies don’t like to think of themselves that way, and frankly the term means less to me than it once did. The range is all the way from the pure fiber players, to the nearly fiberless – but all of whom specialize in connectivity and compete against the ILECs. With no further ado, here is [Read more →]

100Gbps Edges Closer With Multivendor Test

November 16th, 2009

For many in the industry commercial 100Gbps can’t get here fast enough, but it is coming! Today at the SC09 conference in Seattle, a coalition of made up of jnpr, infn, lvlt, Internet2, and ESNet demonstrated a multivendor 100Gbps routing and optical network. This group has been working steadily together since last November. In this case of course, we are talking about the 10x10Gb version of 100G, which requires fewer technical advances and will probably come first. [Read more →]

Cisco Takes Another Swing at Tandberg

November 16th, 2009

After making dismissive noises for a while in response to videoconferencing provider Tandberg shareholders’ resistance to its initial bid, csco has come back with a new offer. The new price of $3.41B is a 13.7% increase over its initial bid of $3B. This time, Cisco seems to have a good number of votes in hand. Shareholders representing some [Read more →]

Weekend Roundup 11/15

November 15th, 2009

Here’s a quick summary of news items that caught my eye this week but for one reason or another I didn’t comment on at the time.

lvlt unveiled substantial upgrades to its customer portal. The new portal offers greater visibility into order placement and review, service and network management, invoice management, and reporting and analysis. It’s one more step [Read more →]

Zayo Expands Fiber to the Tower Effort

November 13th, 2009

Zayo Bandwidth has further expanded its fiber to the tower offensive in eastern Pennsylvania. The company announced today that it will bring another 300 towers on-net in Philadelphia and the Lehigh Valley. It was a little over a year ago that Zayo won a contract with TMobile for tower backhaul in Philadelphia and Memphis, apparently that effort has been going well enough to justify further investment. [Read more →]

Terremark Acquires DS3 DataVaulting

November 12th, 2009

tmrk has acquired DS3 DataVaulting, a Virginia based company that as the name suggests specializes in managed off-site backup and restore services. DS3 will contribute about $6M in annual revenues and $1.5M in EBITDA before synergies. The $11.5M purchase will further add to the company’s expanding managed IT services suite and enhance the company’s presence in the federal market. That’s a market the company has been focusing a great deal of resources on, and they seem to have been making some [Read more →]

Atlanta Next In Line For Level 3’s Local Treatment

November 12th, 2009

Continuing its push to decentralize its business markets group and take fuller advantage of its metro fiber assets, lvlt has turned its attention to Atlanta. The company will add capacity throughout the reason and start bringing on net more of the 15,000 businesses its fiber already passes. Level 3 has long had a major presence in Atlanta, but mainly at the wholesale and network operations level. However, their metro assets in the area are quite extensive, having been assembled from their own original metro build and additonal assets acquired with Telcove, Progress Telecom, and Looking Glass Networks. On the other hand, Atlanta has one of the more competitive [Read more →]

Google, Clearwire, and Subscriber Growth

November 12th, 2009

As soon as WiMAX upstart clwr announced its new funding package this week, you could hear the mumbling. Google didn’t pitch in! Google must not believe in the company any more. Now, I can’t speak for Google directly, but the market consistently misunderstands the companies intentions. Google didn’t invest in Clearwire in order to take over telecom, or even to make a start at it. They did it because it’s worth far more to them to have another last mile alternative in the system than it costs them to help get one started. If they’re not needed to keep it going, then they will [Read more →]

As XO Turns – Intermission

November 11th, 2009

With Carl Icahn’s withdrawal of his bid for the 10% of CLEC xoho he doesn’t already own, the company and its shareholders have entered into a new stage, but one that is clearly temporary and somewhat contradictory. I frankly didn’t think we would wind up in this position, but when it comes to letting his opponents twist in the wind Carl Icahn is an international grandmaster. I see his plan more clearly now in hindsight. Consider the following factors together: [Read more →]

More Metro Fiber Maps: Atlanta, California

November 11th, 2009

Following up on this weekend’s addition of metro fiber map resources to the website, I have added pages for the Atlanta Metro Area and for California. Now one might think that perhaps the largest state in the country might merit more than one page, but for now it seems to work best this way as there actually aren’t all that many public maps available for metro fiber in California – that I know of anyway. I’m sure I have forgotten [Read more →]

Hibernia’s GFN Rides Into Equinix-2,4 In Secaucus

November 10th, 2009

Hibernia Atlantic has extended its Global Financial Network into the NY-2 and NY-4 facilities of eqix in Secaucus NJ, hooking into the Equinix Financial eXchange. The Hibernia hybrid longhaul/metro footprint can now connect Secaucus, Chicago, and London without passing through NYC itself. The more direct routes have the benefit of lower latency, which is all the rage in the financial world right now. [Read more →]

Sprint to Send Home 2500 for Xmas

November 9th, 2009

s has announced more layoffs to the tune of 2000-2500 by the end of the year, which includes some reductions mentioned last week or so in the wholesale group and will be from across the company. They will also be cutting back on outside contractors and other labor costs. The company is looking to find annual savings of some $350M annually and will take a charge of $60-80M in the fourth quarter for severance and such. [Read more →]

Icahn Backs Off For Now, XO Reports Q3

November 9th, 2009

Carl Icahn has withdrawn his bid for xoho, according to an SEC filing. A week and a half ago, ACF Holdings bid $0.80 for the company and gave the XO’s independent Special Committee the weekend to decide. Apparently negotiations went beyond the deadline, but ACF didn’t raise its bid and XO didn’t make a counter proposal. I can’t see this little drama as independent of the XO/R2 litigation, in which a ruling is due soon on Icahn’s motion to dismiss. Depending on your point of view, this was either [Read more →]

Another Quarter of Solid Growth for Cogent

November 9th, 2009

ccoi followed up on its great second quarter with a very respectable third quarter earnings report. Revenues of $60.2M were up 3.9% sequentially – they were up 5% last quarter. EBITDA was $17.0M, up 2% from the prior quarter, and the loss per share was $0.07. Analysts were expecting a bit better on the revenue side, and a bit worse on the earnings side. Last quarter Cogent stopped giving forward guidance, so this was the first quarter the street had to make their guesses blind. The company was one of the first in the sector to feel the effects of the economic downturn, although some of their issues at the time were self [Read more →]

Another $1.5B for Clearwire

November 9th, 2009

What’s that old saying? In for a penny, in for a pound… Apparently it scales all the way up to the billions. According to the Wall Street Journal over the weekend, the backers of clwr are preparing another $1.5B to fund its network buildout. s is supposedly putting up about $1B, while a supporting cast of Intel, Comcast, TW Cable, and Bright House would be putting up another $500M. Is this a real rumor? It likely is. While Clearwire could slow their buildout they clearly don’t want to. Strategically it’s a no-brainer for both themselves and their backers, if they weren’t willing to take this step then they should never have taken the first one. The future is no sure thing, but failing to feed [Read more →]

A First Stab at Metro Fiber Maps

November 8th, 2009

One of the more frequent requests I get is for metro fiber map resources along the lines of the various longhaul maps I have already been collecting and updating. With the holidays fast approaching and the news soon to become almost as sparse as August, I am making this one of my winter projects. I have decided this must be approached on a flexible geographical basis. Specifically, I will try to answer the question ‘Where is there metro fiber in the XYZ area?’ where XYZ is a) generally thought of as a region somehow, and b) has enough metro fiber assets to make a list worth collecting, but not so many to make it confusing. That means some areas I select will be [Read more →]