In today’s fiber world, economic pressures require that companies make the most of their fiber depth. That means that while FTTx is currently getting the most attention, the opportunities with carriers, enterprises, and hyperscalers remain just as important as they always have. Consolidated Communications has always been a major force on the residential side, investing aggressively with their Fidium rollout. But they are also now looking to get even more out of their assets nationwide. With us today to discuss these strategies is Sean Baillie, who joined Consolidated 5 months ago as SVP of Wholesale and Hyperscale.

In today’s fiber world, economic pressures require that companies make the most of their fiber depth. That means that while FTTx is currently getting the most attention, the opportunities with carriers, enterprises, and hyperscalers remain just as important as they always have. Consolidated Communications has always been a major force on the residential side, investing aggressively with their Fidium rollout. But they are also now looking to get even more out of their assets nationwide. With us today to discuss these strategies is Sean Baillie, who joined Consolidated 5 months ago as SVP of Wholesale and Hyperscale.

TR: Tell us about Consolidated. Where do you operate and what capabilities do you have?

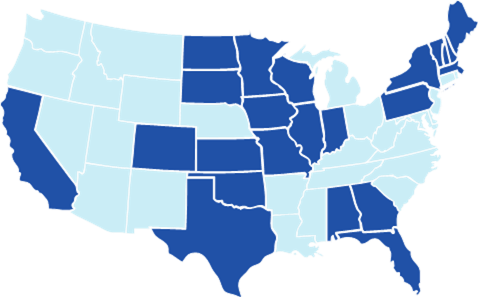

SB: As with any fiber provider, the depth and breadth of our fiber assets is the first place to look. Consolidated is a Top 10 fiber provider in the United States with deep coverage in Northern New England, the Upper Mid-West, Texas, parts of California, and a few other smaller markets as well. These extensive assets allow us to deliver our full suite of services, from Broadband/DIA/Ethernet through to high-capacity transport. Our network’s density also facilitates unique routing and low latency options. We like to say that we are the most attractive fiber provider in our regions due to our extensive reach and creative service offerings. Additionally, as part of our ongoing commitment to growth, we’ve invested over $1.2 billion in new fiber assets to expand our network throughout North America.

TR: Wholesale and Hyperscale haven’t been a big part of Consolidated’s public story historically. What does that division look like today?

SB: While our Wholesale division has been a significant contributor to our success for over a decade, it hasn’t been well known. There’s a long and successful history in tower backhaul, which has resulted in substantial revenue and a fair amount of fiber expansion. The path forward for us is to broaden these achievements to the access, middle mile, and transport capabilities we already possess. Historically, we haven’t consistently communicated these achievements and capabilities, but we are changing that narrative now.

The Hyperscale sector is also an obvious place to focus going forward. Again, we can credibly serve this market in areas where we have assets with highly scalable, low-latency fiber service options.

Each of these market segments would benefit from an energetic and creative fiber competitor, which is exactly what we are.

TR: What do you have planned for the next few quarters?

SB: We have a few priorities for the rest of 2024. The first is to establish our On-Net and Near-Net footprint. Just this week, we launched the first program in the company’s history, with ConnectBase as our partner. This program increases visibility and accessibility to our 160,000+ On-Net and Near-Net locations, offering competitive rates for Broadband, DIA, and Ethernet, along with ICB for higher-level services as needed.

The second focus area is capital deployment. We are constantly edging out our network and developing new footprints to work with in partnership with our Wholesale customers. We execute fiber builds extremely well. This will continue as we are always looking for win/win network expansion opportunities. I expect the Hyperscalers will push us along as well as we become more known to them.

Wrapped around all of this is marketing. We have a concerted effort to be more vocal about where we operate and what we do.

TR: What projects are you working on in northern New England?

SB: In northern New England, we are everywhere, with long-haul, middle-mile, and metro density. We are the region’s largest fully-owned and managed fiber network, with more than 380 network access points. In addition to launching our On-Net/Near-Net program, we have developed multiple unique high capacity routes throughout the footprint and will continue to do so based on customer requirements.

TR: How about in Texas, the upper Midwest, and California?

SB: In Texas, we are focusing on our DASH (Dallas-Austin-San Antonio-Houston) Network. We have some unique capabilities in these markets, and we are seeing increased interest in what we can deliver. We are well positioned to serve all sectors in Texas, but our particular focus is on third-party data center customers and Hyperscale developments. Both are highly active around Dallas, San Antonio, and Austin. We are well-positioned to serve these customers.

In the upper Midwest we have network density in Minnesota, Fargo, Des Moines and parts of Illinois with capacity between markets as well. We have existing low latency/unique availability and ongoing market edge-out projects moving.

In California we are focused on our deep footprint in and around Sacramento. Specifically, we are looking closely at a project to overbuild and develop a brand new, unique data center to data center platform for all data centers in and around that market.

Our On-Net/Near-Net initiative covers all of these markets as well.

TR: How have you prepared the business to take on these tasks?

SB: Given the above capabilities, we expect sustained volume and revenue growth. We have taken a key initiative to continue to provide an excellent customer experience while scaling the business. We have built dedicated pre-sales care, install, and post-sales care teams that are staffed with excellent long-term employees who understand the dynamics of these market segments. Our OSP and field technicians get very high marks, understand their markets extremely well and deliver for our customers. All of these groups are ready for our next phase of growth.

TR: Anything else you’d like to offer?

SB: Consolidated has been the best kept secret in the fiber world. We feel the market needs a competitor like Consolidated with the assets, energy and partnership mindset to shake things up a bit.

TR: Thank you for talking with Telecom Ramblings!

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Fiber Networks · Industry Spotlight · Metro fiber

Discuss this Post