I have updated the competitive telecom trends graphs with the data from Q1 and the stock price movements since. There are a few interesting highlights worth zeroing in on. The charts below are snapshots, you can play with the interactive data on the main competitive telecom trends page.

|

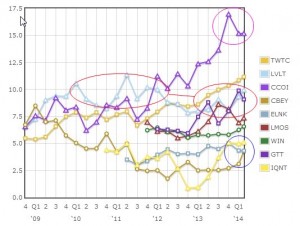

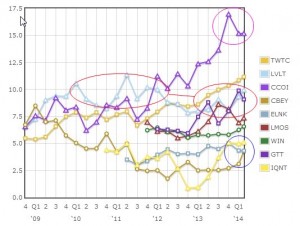

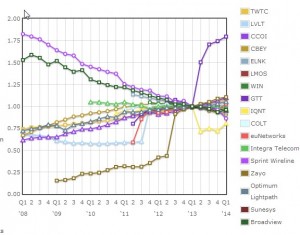

Relative Valuation, i.e. EV/EBITDA — While Level 3’s stock price has been having a bit of a party lately, moving solidly over the $40 level and making its long-suffering investors happier than they’ve been in a while, the company’s relative valuation hasn’t actually jumped that much. At just under 10x EBITDA, the company has at most won back some of the premium it used to have a few years back based on the underlying assets. Cogent and tw telecom each still get more credit for their EBITDA at the moment, and I have no idea how Cogent’s EV/EBITDA stays way up above 15 so effortlessly. Meanwhile, Birch’s purchase of Cbeyond brought Cbeyond’s valuation only back to the bottom of this list, into a dead heat with Earthlink. |

|

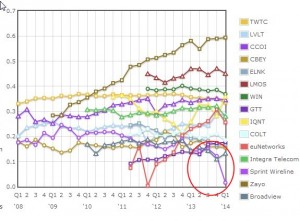

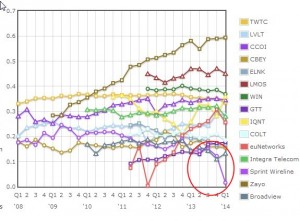

Adjusted EBITDA Margins: Only one thing of note happened on this front that wasn’t noise or a steady trend. Yes, I’m wondering what happened over at Sprint Wireline? I had noticed the number when it came out, but it hadn’t really registered. Was it just a blip? Or did they finally reach the point where revenue declines ran up against fixed costs? They didn’t really spend much time talking about it. |

|

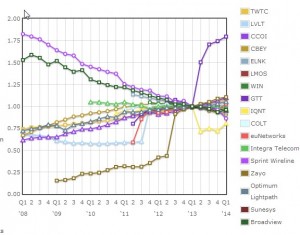

Relative Revenue Growth: I have been trying to make this graph visually informative for a while, but it has been hard. The relative scales of organic and inorganic changes have been so different, too often you only see M&A. But I think I have the formula now, taking things relative to 4-5 quarters back. In the graph to the left, we see the two halves of one recent M&A event (Inteliquent/GTT) to the right of that date, and the historical bumps for Zayo/AboveNet, LVLT/GLBC, and euNetworks/LambdaNet. But we can also see the long term organic trends with Sprint, Broadview, and EarthLink declining briskly, Integra holding pretty steady, and the rest of the field (mostly fiber-heavy operators) ascending slowly. Zayo’s recent European M&As won’t show up here until next quarter. |

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: CLEC ·

Fiber Networks ·

Financials ·

Metro fiber

I’d also note the sustained expansion of TWTC’s multiple.

Good point. TWTC does seem to be getting some additional respect, perhaps in anticipation of higher growth rates from their various investments over the past six quarters.