This is a guest post by Paolo Gorgò. To inquire about guest posts, contact the webmaster.

Today, TeleCity Group announced its results for the first half of 2012.

In line with expectations, the company delivered solid growth both in revenues and EBITDA.

Here is a quick look at some of the highlights:

- Revenues were up 22.4% Y/Y to £137.3m ($ 214 million) – on a same currency basis growth was about 25.6%

- EBITDA was up 26.6% Y/Y to £62.6m ($ 97.5 million), or 45.6% of revenues. On an FX neutral basis it grew 30.4%

- Adjusted diluted earnings per share were up 36.2% to 15.8p, with currency neutral growth of 41.1%

- The company announced a maiden interim dividend of 2.5p per share

- TeleCity acquired Tenue Oy, a Finnish data centre operator, on a debt and cash free basis, for cash consideration of £3.7m plus associated costs of approximately £0.4m.

The company closed the first half of 2012 with an 81.3% occupancy rate, an increase from last year’s 80.3%.

In spite of a weak European economy, demand for network-neutral data center space is described as strong by TeleCity, in line with similar comments from competitors like Equinix and InterXion.

During the first half of 2012 the company opened about 4,800 sqmt. (51,650 sqft.) of additional data center space, or 8MW.

Tenue’s acquisition is described as a strategic entry into a market which is a a crossroads for Internet traffic between Eastern and Western Europe. Tenue has about 1 MW of operational capacity, with potential to increase up to 4 MW.

[paoloadbox]

The recent acquisitions of Data Electronics and UK Grid contributed with £ 8.0 million to revenues and £ 1.8 million to the company’s EBITDA in the period. TeleCity Group continues to pursue further acquisitions, to enter new markets or provide growth capacity in existing markets.

As we write this article TeleCity’s stock price is up 7%, as the market seems to appreciate the company’s earnings and strategic acquisition. In general, post earnings performance has been quite positive for most data center stocks, so far.

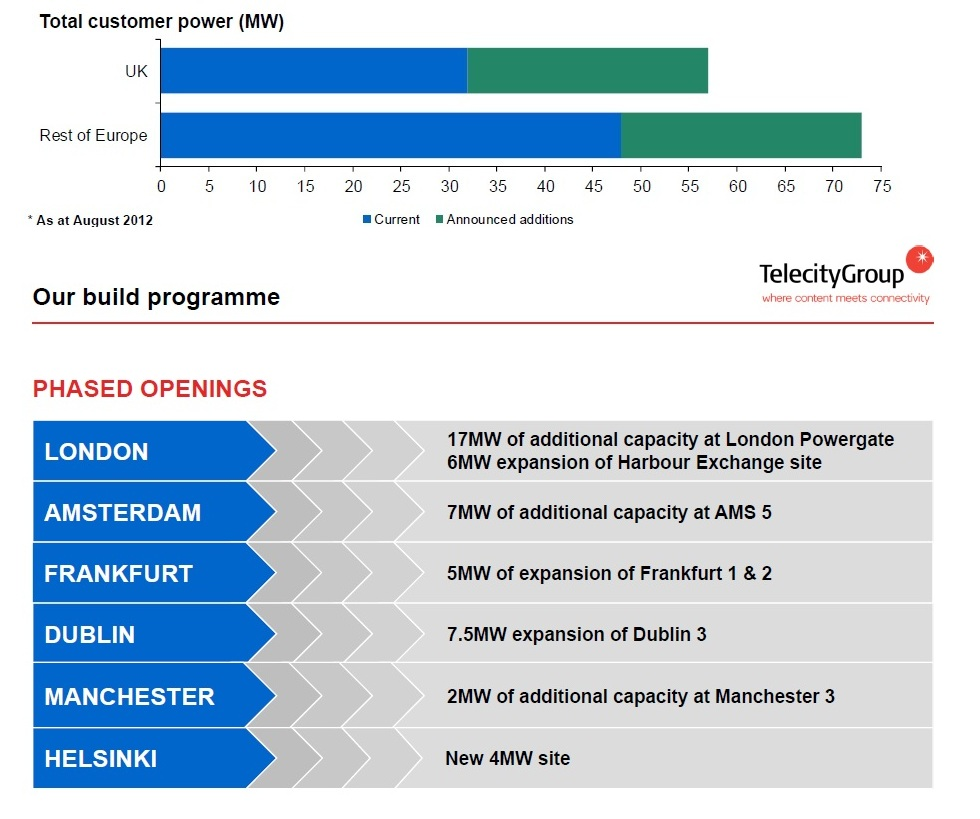

Here is chart, taken from the company’s earnings presentation, showing TeleCity’s pipeline in terms of expansion projects in the next few months.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Datacenter · Financials · Mergers and Acquisitions · Other Posts

Discuss this Post