Today the wireless backhaul specialist ftwr finally surrendered to the inevitable and announced that it has filed voluntary petitions for Chapter 11 bankruptcy in North Texas. Under the proposed reorganization, the $176M in long term debt would be eliminated and the creditors would then take over the company – the usual sort of thing. This follows a restructuring just over two years ago in which they cut debt in half, which obviously didn’t do the trick.

FiberTower has been looking at strategic options since last November when they skipped an interest payment and started negotiating with debt holders. The company’s assets were out there for sale, but apparently any offers generated did not rise to a high enough threshold. That doesn’t mean that a buyer won’t make a move now that the company has filed for BK, as it may offer additional opportunities for reorganization.

FiberTower took its hybrid fiber/microwave approach to the mobile backhaul space too early, and just never managed to generate the revenues per tower that it needed to justify its buildout costs. Also, by focusing mainly on towers they were unable to really benefit from the scale that might have come from other metro fiber targets such as mid-sized enterprises for whom the economics have gotten better and better. While a few are now starting to make headway on it, in general the tower backhaul business still seems difficult as a standalone model.

FiberTower took its hybrid fiber/microwave approach to the mobile backhaul space too early, and just never managed to generate the revenues per tower that it needed to justify its buildout costs. Also, by focusing mainly on towers they were unable to really benefit from the scale that might have come from other metro fiber targets such as mid-sized enterprises for whom the economics have gotten better and better. While a few are now starting to make headway on it, in general the tower backhaul business still seems difficult as a standalone model.

That’s why I think that FiberTower’s future may still be to become the wireless backhaul division of a company with an existing metro fiber business, or add depth to an existing FTTT player like Zayo. But it might work in pieces too – FiberLight and either Sidera or Fibertech could probably split it down the middle if they felt the urge, for instance.

But for now the order of the day will be to continue operating through the reorganization process with annual revenues in the $70M range and perhaps $4-5M in adjusted EBITDA.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Financials · Wireless

The debt holders used to be the bit tower companies themselves. Not sure how this would end up as part of Zayo or others. I would think American Tower and CCI might have another run at it once the common shareholders are wiped out.

I believe it is a similar business model to PEG Bandwidth.

Good afternoon everyone. Long time reader, first time poster….what a great blog and forum to read on a daily basis. It took that one “special” post to drag me in here.

Mike Hammett, good afternoon. With all due respect, the PEG Bandwidth business model is not even remotely close to FiberTower’s business model other than we’re both in the cell site backhaul space.

1. PEG Bandwidth is in the process of building a fiber-based (80%+) backhaul network. FiberTower built a microwave-based backhaul network. This made scalability incredibly difficult as the carriers moved to 4G.

2. PEG Bandwidth’s 2,000+ awarded sites are all Native Ethernet-based architecture. FiberTower’s entire network was built on TDM architecture. This made the move to Ethernet Backhaul (now a virtual ubiquitous requirement from the carriers) incredibly resource-draining, capital intensive and operationally challenging.

3. PEG Bandwidth has never built one tower without a customer contract in hand for that tower. FiberTower’s early investors (the MTOs) strongly urged the business to deploy their backhaul services often in advance of contracts. There were several entire-market build-outs that completed without any revenue to support the return on that investment.

4. PEG Bandwidth is an equity-backed business and, thus far, has taken on no debt. At some point, it may make sense to take on some debt but that will be a future decision. FiberTower borrowed $500M at a time when its investors urged them to quickly deploy their services in large Tier 1 markets. This created a debt load that, eventually, they could not meet.

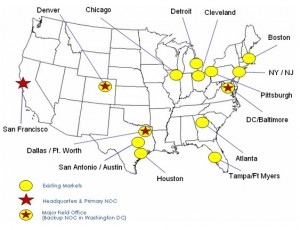

5. PEG Bandwidth is focused on Tier 3, 4 and rural markets where there is less fiber in the ground and, therefore, less competition. FiberTower deployed in Tier 1 markets exclusively (Waco, notwithstanding). These Tier 1 markets were great early on, but as the move to 4G forced the wireless operators to allocate capital budgets to subsidize fiber build outs in their markets, all the LECs and MSOs were able to justify fiber builds to those same towers where FiberTower had placed MW, creating immediate and virtually unbeatable competition at those towers.

FiberTower was a fun place to work and was undoubtedly a pioneer in the alternative access vendor (AAV) space.

PEG Bandwidth is a fun place to work and we hope to have learned from many of FiberTower’s mistakes to create the best provider of customized cell site backhaul solutions.

Cheers, ladies & gents.

Greg Ortyl

Sr. VP Sales & Marketing

PEG Bandwidth

FiberTower’s Proposed Plan of Reorganization – Unsecured Creditors & Shareholders to Receive No Recovery

http://chapter11cases.com/details-of-fibertowers-proposed-plan-of-reorganization-agreement-with-holders-of-2016-notes/

I think there is still some value in their 24 GHz spectrum. Those tier one markets will need some help with their Small Cell deployments and that band will fit well.