After taking a couple years off, Zayo has hopped back into the M&A driver’s seat. Yesterday the fiber builder and operator announced a definitive agreement to acquire Intelligent Fiber Network. Zayo only recently sold off its zColo division to DataBank, refocusing the business onto fiber.

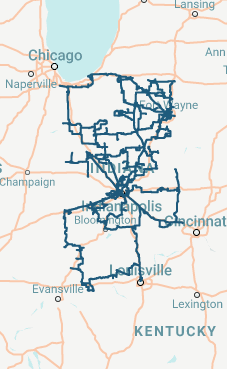

IFN operates a 5,000 route-mile network serving some 400 customers primarily within Indiana. They have long been a part of the Indatel network, having been founded by a coalition of independent telcos in the region. More recently they had opened up that membership to include a local energy utility as well. They also rebranded from Indiana Fiber Network to Intelligent Fiber Network a few years ago and began looking to expand their regional presence. We had IFN’s Kelly Dyer here a few years back for an Industry Spotlight article.

IFN operates a 5,000 route-mile network serving some 400 customers primarily within Indiana. They have long been a part of the Indatel network, having been founded by a coalition of independent telcos in the region. More recently they had opened up that membership to include a local energy utility as well. They also rebranded from Indiana Fiber Network to Intelligent Fiber Network a few years ago and began looking to expand their regional presence. We had IFN’s Kelly Dyer here a few years back for an Industry Spotlight article.

For Zayo it’s a bit like coming home, given that one of the company’s very first acquisitions back in 2007 was Indiana Fiber Works. They have invested significantly in infrastructure in the state over the years since then as well. But IFN’s footprint will give them more depth, adding another 1,000 on-net buildings to their footprint across the state.

It also brings back memories of Zayo’s purchase of US Carrier down in Georgia, which was also built and operated by a coalition of independent telcos. Such assets have remained relatively aloof from the consolidation in the markets over the years, but obviously not entirely. There are other such opportunities out there if Zayo is looking for them (and they might be).

The deal is expected to close during the second half of 2021, and financial details were not disclosed.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Fiber Networks · Mergers and Acquisitions

This deal is not good for the Indiana. This merges the two most extensive networks in the state, removing competitive options for many markets.

Do you think regulators will object?

I have little faith that regulators ever do anything competently.

I wonder which regulators would have authority.

If the main complaint is a small IX whose complaint is always about price, then no, they will not object.

Is anything I said incorrect?

I’m also well connected (at layer 8) to operators throughout the state. It’s a common feeling. There’s also the feeling that the transport service quality would degrade as Zayo has a poor reputation for quality in Indiana.

The Zayo diaper is getting pretty full.

Disagree. Merging the 2 largest assets will make them more uniform giving the end users of Indiana more transparency on their traffic. Zayo is a carrier’s carrier, they are not going to nickel and dime a small market like IN for nominal gains.

Please explain what you mean by “make them more uniform”. I have an idea, but I don’t want to speak for you.

What does “transparency on their traffic” mean?

“Carrier’s carrier” doesn’t really mean much. Can the desired service be delivered reliably at a desirable price point? Yes or no. Unfortunately for many operators I know in Indiana, Zayo and reliable aren’t synonymous.

End users prefer a single carrier own a circuit end to end. Having multiple companies involved only opens the door for finger pointing.

Can the desired service be delivered reliably at a desirable price point? – Yes, Zayo is aggressively priced and offers industry standard SLAs.

Many happy Zayo customer’s in IN, one recently spend a lot of $$$ doing a network expansion. You are not seeing the whole picture.

When will the Spirit idiots be fired from Segra so Zayo/EQT can absord them…. after they sell the fake Spirit assets?

Segra and Lumos are full of idiots, they have the worst leadership I’ve seen in years. Lumos has no idea what they are doing and Segra isn’t far behind. As detailed and analytic as EQT is, I would have expected them to see through these incompetent people. Throwing Segra into the Zayo mix would only breed more poor management. My recommendation would be to sell Lumos to a local/regional operator and have Zayo purchase the Segra assets, not their Executive team.