The wait is over, GTT has made its deal to sell its fiber and data center infrastructure division. They have signed a definitive purchase agreement with I Squared Capital for $2.15B.

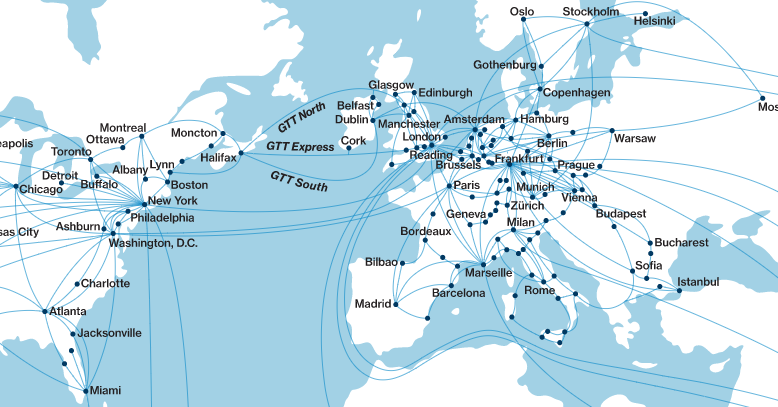

GTT’s infrastructure division operates a 103,000 route-kilometer fiber footprint, three submarine cables, and 14 tier 3 data centers plus some additional colo space across 100 other locations. The subsea cables, of course, come from the purchase of Hibernia Networks. Hibernia also had a bit of fiber in North America in Europe, and KPN International contributed some in Europe as well, but the bulk of the terrestrial fiber came from Interoute.

GTT’s decision to sell the division came after the company ran into difficulties in the integration and operation of those assets last year. By selling them off, they hope to rekindle the asset-light approach that had been working so well for them for many years prior to those deals.

I Squared also owns Hong Kong-based HGC Global Communications. Just what I Squared plans to do with all these assets is still an open question. They might roll them all up together, or they might do something else. They might not be done either… There are other assets in Europe for sale right now that they could attempt to consolidate with these – Telia Carrier springs to mind, for example. At the moment the newly carved-out assets don’t even have a name, though maybe we can just call them Interoute, haha.

The deal is expected to close in the first half of next year. It consists of $2.02B in cash at closing plus another $130M tied to ongoing financial performance metrics.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Datacenter · Fiber Networks · Mergers and Acquisitions

I’ll never undestand people that sell their underlying assets. It doesn’t work out in the long-run.