Reports over the weekend emerged that Italy’s TIM Group is taking a look at the future of its international division, Sparkle. The word is that the investment bank Rothschild will be hired to advise TIM about a potential sale.

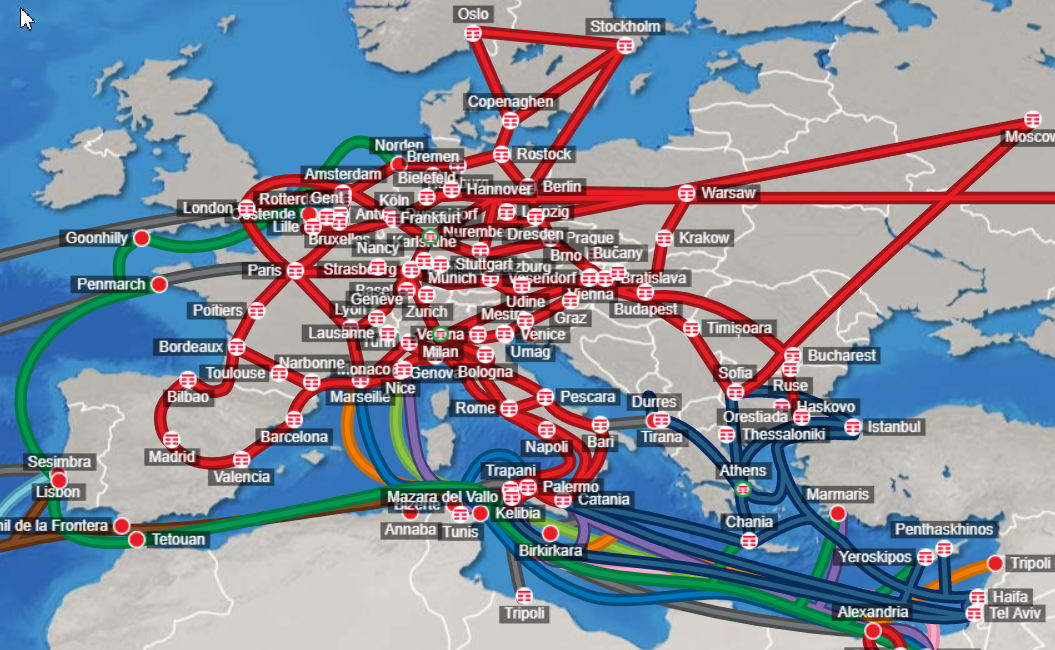

Sparkle operates the group’s international cables and global IP backbone. Sparkle has been expanding its reach in recent years, and has been active in the southern Atlantic subsea markets, taking a big piece of Seabras-1 and coordinating with SAEx.

Sparkle operates the group’s international cables and global IP backbone. Sparkle has been expanding its reach in recent years, and has been active in the southern Atlantic subsea markets, taking a big piece of Seabras-1 and coordinating with SAEx.

According to Capacity, the activist investors that control the company think of it as non-core for TIM. However they may face opposition from the Italian government, which sees Sparkle as critical national infrastructure. If they are still of that mindset then the potential list of buyers gets a lot shorter, with the state investment group CDP being the name that comes up.

There are several international wholesale divisions that have or might become untethered from their national, mobile/PTT-focused parents in recent years, such as Telefonica’s spinoff of Telxius, KPN’s sale of iBasis to Tofane Global, and the recent rumors of a sale of Reliance’s GCX. Sparkle probably won’t quite go that route at this point, but it’s worth watching what Rothschild recommends to TIM.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Mergers and Acquisitions · Undersea cables · Wireless

Someone has to have seen Carl by now. He’s a big time investor….

This article led me to click the sparkle ad banner on the right… which definitely did not link me to the correct Sparkle….