Another of this year’s fiber M&A deals has closed, bringing a new player onto the scene. The Australian-based private equity firm AMP Capital has completed its acquisition of Everstream, which can now turn its attention to further growth.

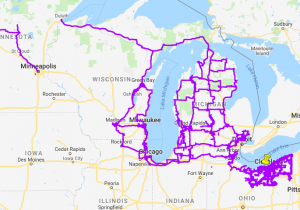

Everstream’s network stared off in northeastern Ohio, expanded throughout Michigan and into Wisconsin via the acquisitions of GLC/Comnet and Lynx Network Group. The company’s footprint now spans some 10,000 route miles, hooking up 2,139 on-net buildings across the region.

Everstream’s network stared off in northeastern Ohio, expanded throughout Michigan and into Wisconsin via the acquisitions of GLC/Comnet and Lynx Network Group. The company’s footprint now spans some 10,000 route miles, hooking up 2,139 on-net buildings across the region.

Everstream and AMP Capital are quite open about their interest in further consolidation of fiber assets in North America, but also have plenty of organic opportunities ahead of them. It should be interesting to see where they turn their attentions this winter and into 2019.

Before AMP stepped up, I thought there might be a chance they’d combine with one of their private-equity-backed neighbors: FirstLight Fiber to the east or Lumos Networks to the southeast. Other possibilities now could be players like IFN, Independents, Bluebird, iRis, or WIN — if they can convince those groups of local telephone companies that own each to part with their regional networks. Then there’s the Canadian market, hmmm.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Mergers and Acquisitions · Metro fiber

Discuss this Post