The third quarter was a busy one for euNetworks, which posted solid growth while adding some significant new longhaul and metro assets to its network. Revenue grew to €34.9M while normalized adjusted EBITDA expanded to €13.1M. Here are a few of the ir numbers in some context:

| in millions of €, UOS | Q3/16 | Q4/16 | Q1/17 | Q2/17 | Q3/17 |

|---|---|---|---|---|---|

| Revenue | 31.8 | 32.3 | 32.6 | 33.8 | 34.9 |

| Adj. EBITDA | 10.8 | 10.6 | 10.7 | 12.5 | 12.8 |

| Normalized Adj EBITDA | 11.0 | 11.7 | 11.3 | 12.1 | 13.1 |

| Norm. Adj EBITDA margin | 34.6% | 36.2% | 34.7% | 35.8% | 37.5% |

| Capital Expenditures | 11.9 | 16.5 | 14.2 | 16.9 | 17.1 |

| Proxy Cash Flow | (1.1) | (5.9) | (3.5) | (4.4) | (4.3) |

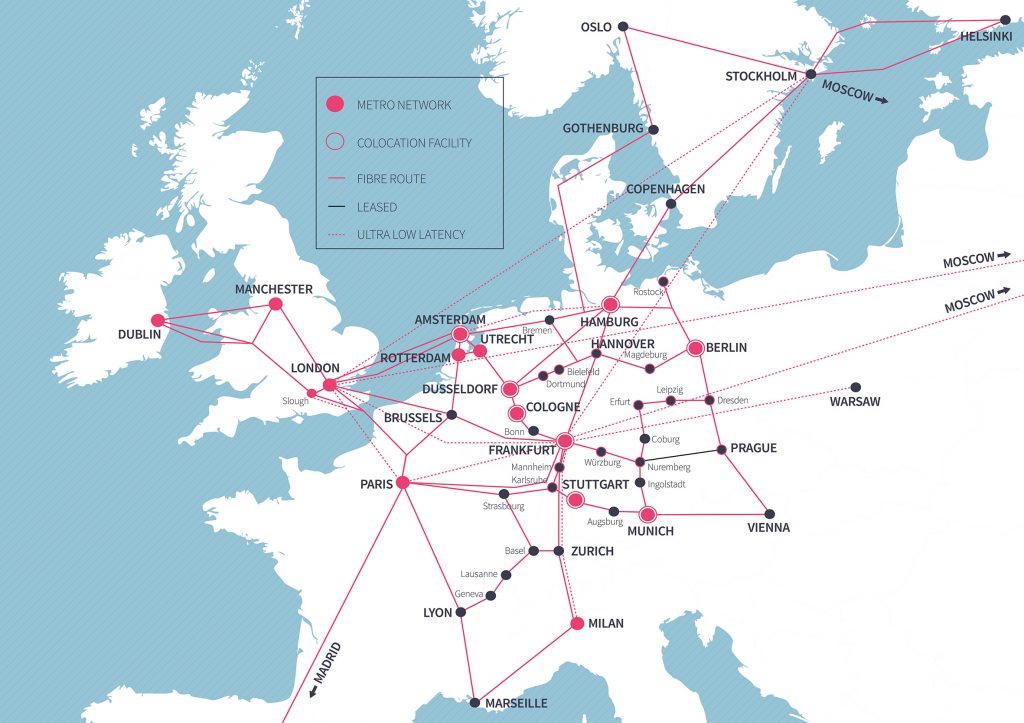

Capital expenditures remained high as the company continues to invest its cash flow plus some in network development. Along with the Manchester metro expansion they announced in August, euNetworks has added several new longhaul routes taking the company into some new markets:

- Helsinki – Two diverse routes across the Baltic Sea from Stockholm into the Finnish capital, the north along an established fiber route and the south on a newly built route that is just going live this month.

- Madrid – A route from Paris to Madrid which will come online during Q4. It seems likely that for diversity sake, they’ll also be adding one from Marseille at some point.

- Vienna and Prague – An expansion eastward from Munich into Austria and the north through the Czech Republic and back into the German city of Dresden.

They have also been investing in the company’s German longhaul network, adding more 100G depth between their other metro markets in the country. Here’s a snapshot of the company’s latest network map after the latest organic expansions:

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Fiber Networks · Financials · Metro fiber

Discuss this Post