According to a report from Bloomberg late yesterday, GTT is making another key inorganic move. The CEO of Perseus, Jock Percy, has apparently been quoted as saying that GTT will be buying the company for $39.5M. [GTT has now clarified the purchase price as $37.5M plus the assumption of $3M in capital leases]

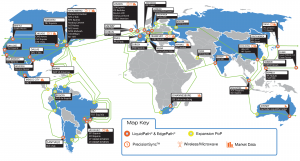

Perseus specializes in the ultra low latency connectivity used by the high frequency trading community. They run some microwave networks and manage carefully assembled routes between financial exchanges around the globe, touching 75 PoPs in 18 countries with connectivity into more than 200 financial exchanges.

Perseus specializes in the ultra low latency connectivity used by the high frequency trading community. They run some microwave networks and manage carefully assembled routes between financial exchanges around the globe, touching 75 PoPs in 18 countries with connectivity into more than 200 financial exchanges.

GTT gained some exposure to the HFT financial sector when it bought Hibernia Networks earlier this year of course. Hibernia operated network assets aimed at the financial vertical, not the least of which was Hibernia Express, the new ultra-low latency cable system across the Atlantic that was launched in 2015.

Buying Perseus will take them significantly deeper into that segment, which seems like a natural followup for which there will be some achievable synergies.

Yet the HFT world has some sharp elbows. For instance, Goldman Sachs bought a minority stake in the company two years ago for $20.5M, which is more than half of the quoted purchase price, suggesting even they lose a few dollars now and then.

That being said, we’re still waiting for the official announcement on the deal and actual financial details. It’ll probably hit later this morning considering the news is already out there.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Internet Backbones · Low Latency · Mergers and Acquisitions

Perseus can’t be that significant if they’re only valued at $30m. One of their competitors spent $14m on land next to CME just to use only 15 sq. ft. of it.

Is that a comment on Perseus value or the 15sqft?

GTT is is in a disappearing business as a ISP. Basically content is buying direct from eyeballs that is not going to change. I appreciate them trying to diversify, however I am not impressed so far with the choices they have made.

Backbone ISPs will always be needed, unless you plan on everything becoming a walled garden, and going back to the AOL days. Its just not the ‘sexy’ business it once was, and thus some companies go elsewhere to try to impress the market.

GTT issued their own PR on this deal now, adding some details. Post-synergy adjusted EBITDA will be 5.0x or lower, and the integration should take two quarters. The deal also brings GTT capacity on Pacific Express as well as new PoPs and routes in LATAM and APAC markets.