The Carlyle Group has done a bit of network M&A overseas. The US-based private equity group has acquired a majority stake in the global carrier CMC Networks.

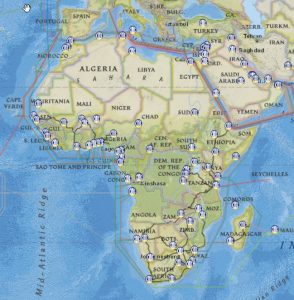

CMC Networks is a carriers’ carrier that specializes in connectivity in Africa and the Middle East. They operate a pan-African network that reaches into 50 countries and a broader footprint reaching 106 PoPs worldwide, selling a suite of transport and data services to network operators with needs outside their footprint. The company has been nursing expansion plans in Asia and South America, and backing from the Carlyle Group will likely help them fund such plans.

CMC Networks is a carriers’ carrier that specializes in connectivity in Africa and the Middle East. They operate a pan-African network that reaches into 50 countries and a broader footprint reaching 106 PoPs worldwide, selling a suite of transport and data services to network operators with needs outside their footprint. The company has been nursing expansion plans in Asia and South America, and backing from the Carlyle Group will likely help them fund such plans.

While full details were not disclosed, the deal cost Carlyle more than $100M, with the necessary funds coming from the firm’s Sub-Saharan Africa fund. Financing was also provided by the Standard Bank of South Africa and Rand Marchant Bank.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Internet Backbones · Mergers and Acquisitions

Discuss this Post