Telstra’s acquisition of Pacnet is a done deal, as Australia’s incumbent closed the purchase last night. And the first thing they did was announce the progressive retirement of the Pacnet brand.

They didn’t waste any time either, as Pacnet’s website is already gone — I’m thinking they forgot to set up a fowarding though. Telstra is still waiting for one last regulatory approval in the USA for Pacnet’s assets there, but that shouldn’t be a problem I’d think.

They didn’t waste any time either, as Pacnet’s website is already gone — I’m thinking they forgot to set up a fowarding though. Telstra is still waiting for one last regulatory approval in the USA for Pacnet’s assets there, but that shouldn’t be a problem I’d think.

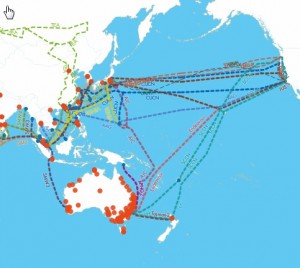

Telstra announced the $697M purchase just before Christmas of 2014. It gives them a boost in intra-Asian fiber connectivity as well as Pacnet’s transpacific route on the Unity cable system. But perhaps even more strategic is the joint venture managed services and data center business in mainland China.

With the Australian market still in flux as the NBN rolls out, Telstra’s international interests have been sitting in the front seat. With the Pacnet deal done and their APAC infrastructure added to the mix, I suspect Telstra will be looking at other inorganic opportunities to further their reach. Reliance’s GCX perhaps?

There are similarities. Both Pacnet and GCX have assets of pre-dotcom-bubble submarine cable origins, both have been working to remake themselves as cloud connectivity providers, and Bill Barney has been CEO of each. Hmmm.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Fiber Networks · Mergers and Acquisitions · Undersea cables

Discuss this Post