This article was authored by Phil Marshall, and was originally posted on telecomasia.net.

This month I published a research report on the telecom tower industry; an industry that I have followed for nearly two decades since its inception in the United States in the mid-1990’s. In recent years, the tower industry has expanded at an incredible rate, particularly as operators seek cost effective network expansion strategies, and network sharing becomes more readily accepted.

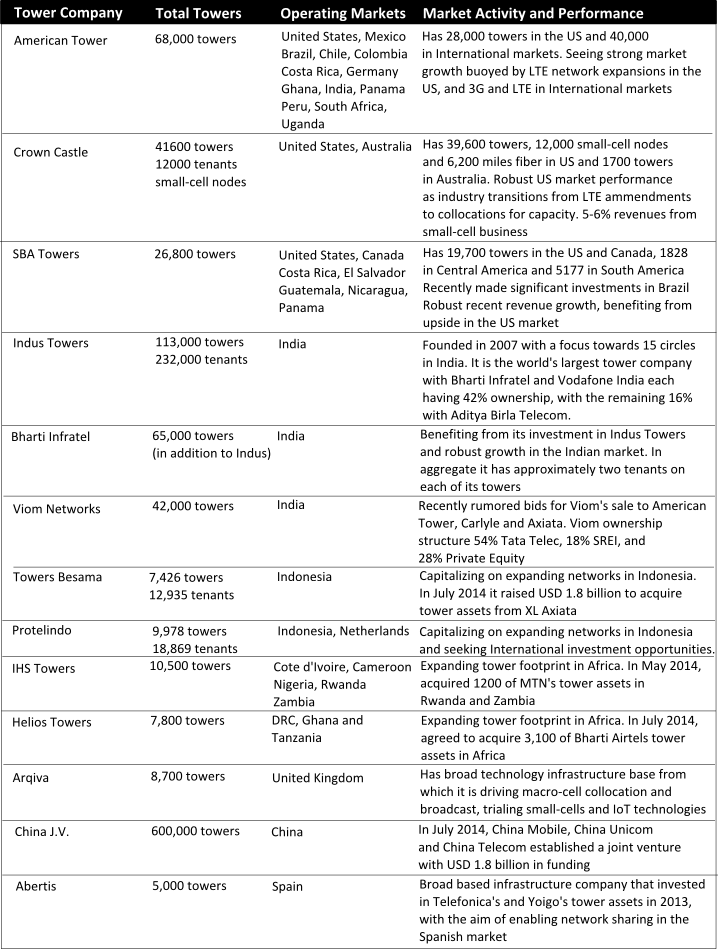

Snapshot profiles for the major tower companies for the beginning of August 2014 are shown in Exhibit 1 below. The US is dominated by American Tower, Crown Castle and SBA. American Tower and SBA have been investing internationally. Crown Castle is paying greater attention to growth opportunities in the US market, such as small-cells and distributed antenna systems (DAS).

Other companies like Indu Towers, Bharti Infratel and Viom Networks operate in India, Tower Besama and Protelindo in Indonesia, Helios and IHS in Africa and Aqqiva and Abertis in Europe. The profiles shown in Exhibit 1 are continuously changing as tower companies make new investments. For example, IHS’s recent acquisition (August 11, 2014) of over 2000 towers from Etisalat in Nigeria is not reflected in its profile.

For many industry punters, the value proposition for tower infrastructure outsourcing seems straight forward. It goes something like this…..

Service providers don’t need to own their towers and don’t need to be in the business of managing “heavy iron” infrastructure. Instead service providers can sell their towers to an independent tower company and benefit from a lump sum capital payment and the elimination of tower operational responsibilities.

As for the tower companies, they are in the real estate investment business and are bound to be attracted to tower assets with reliable long term tenancies.

If it were so simple, why do so many service providers, (including high profile players like America Movil), still retain their towers – albeit in many cases through subsidiary companies? Also why do tower companies shy away from so many deals and require such high return expectations, particularly in markets like Africa?

In reality, tower outsourcing is not always the best strategy for a service provider and not all potential deals make sense for a tower company. Most deals don’t work with a simple sale and lease back arrangement, but depend on future upside revenues from new tenants, and network expansions and overlays.

When a service provider sells its towers, the lump-sum capital they receive for the towers comes at a cost; which is effectively the monthly tower rental revenues less the operational costs that are passed to the tower company with the transaction. This cost must stack up against other sources of capital, such as debt financing. For a tower company, a transaction is by no means risk free, particularly if its success depends on future growth. Key risk factors include:

- Unforeseen regulations that compromise the utility of the towers. This might involve changes to zoning laws, licensing fees and mandated foreign ownership structures.

- Changing market conditions and technology advancements that reduce tower requirements. For example, service provider consolidation can result in equipment decommissioning, and the miniaturization of radio infrastructure can reduce tower capacity demands. Fortunately the growing demand for mobile services can mitigate many of the market and technology risks associated with tower deals. This is even the case as mobile networks migrate to 4G and 5G, since macro-cellular towers are needed to maintain service continuity.

I expect that the telecom tower industry will continue to see robust growth over the next 24 to 36 months, particularly as service providers seek cost effective strategies for expanding their networks.

Currently there are more tower deals in the offing than there is available capital. With this in mind, operators need to carefully evaluate the business case from a tower company’s perspective and relative to other sources of capital. In some cases, operators might find that outsourcing is currently too costly and opt to retain their tower assets.

Exhibit 1: Investment profiles of notable independent tower companies

Source: Tolaga Research, 2014

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Other Posts · Wireless

Typically the larger the tower company, the more out of touch they are with small operators. My industry typically avoids standard commercial towers. You can give a guy a free $60 Internet account for using his grain leg. No NRC. OR you can pay $800/month to Crown or SBA with thousands up front in application, engineering, etc. fees.

A standard commercial tower is typically more convenient than a grain leg, however. Local or regional tower companies (say less than 300 towers) typically offer the best bang for the buck. $200 – $500 depending on loading and location. Done.

American Tower took years to realize this and came up with a program for the fixed wireless industry. It’s not a great deal, but it is much better than their past and better than Crown\SBA.

MY PLOT MOBIL TOWER MATE BHADE AAPVA OK CHU