Private equity has found another network operator to bring into the fold this week. Tiger Infrastructure Partners is acquiring a majority interest in Paramus, NJ-based Hudson Fiber Network.

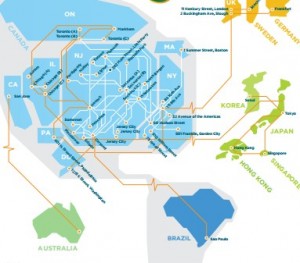

HFN’s specialty has been low latency connectivity aimed at the financial industry, and in purpose-built networking projects more generally. They have a presence in the key markets on five continents, but their primary market has always been the New York metro area.

HFN’s specialty has been low latency connectivity aimed at the financial industry, and in purpose-built networking projects more generally. They have a presence in the key markets on five continents, but their primary market has always been the New York metro area.

They tend to work with local network builders and existing infrastructure to piece together optimal routes. Last year, for instance, they teamed with Cross River Fiber to optimize connectivity to Mahwah from other key points in northern New Jersey, and with euNetworks for a route between Slough and central London.

Financial terms were not disclosed, and the deal should close next quarter. The current management team led by Brett Diamond will continue to hold a significant majority stake in the company. I am curious what they will use the new capital injection on.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Low Latency · Mergers and Acquisitions · Metro fiber

Discuss this Post