The European private equity group Cinven has made a pretty big move into the fiber business with agreeing to the purchase of GNFT, the fiber arm of Gas Natural Fenosa. For a pricetag of approximately $680M, they will get a substantial foothold in the internet infrastructure markets in Spain and parts of of Latin America. Now the question is, what will they do with it?

|

|

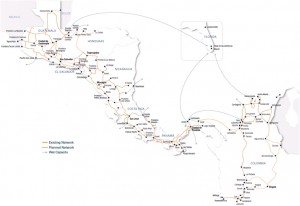

GNFT operates some 30,000km of fiber infrastructure along the GNF energy rights of way in two contigous geographies. The first is a national Spanish network with an extension over to Portugal. The second is a regional network stretching from Belize and Guatemala in the north to Colombia in the south, although the links between the Panama and Colombia footprints are subsea rather than terrestrial. While there is an obvious language link between the two, it seems like two rather different opportunities.

Latin America’s bandwidth markets are on the upswing, as deeper and more sophisticated terrestrial infrastructure takes over from the submarine capacity to the ports that we used to associate with the region. Seems like Cinven could easily use this as a starting point to make further inorganic moves north into Mexico, south into other South American markets, or even east into the Caribbean subsea markets.

Meanwhile Spain is a bit more of a mature infrastructure market in the context of a depressed regional economy. It’s a bit harder to envision it as a consolidation platform, and easier to see it as a value play in advance of a sale to a strategic player a few years down the line.

In the past Cinven has held stakes in European cable operators like Numericable and Ziggo. What they will do with a wholesale fiber and transport business should be interesting to watch.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Fiber Networks · Mergers and Acquisitions · Metro fiber

Discuss this Post