In its second European acquisition in the past month, Zayo has bought itself some more fiber. This time it’s an asset that has been for sale for a while, and which they always seemed to be the right buyer for: Geo Networks.

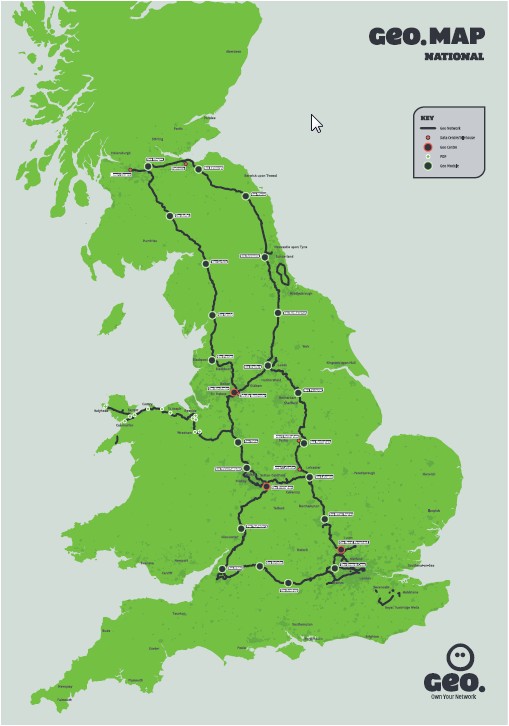

Geo offers dark fiber and conduit throughout the island of Britain with a foothold over in Dublin. Their network spans 2,100 route miles hooking up 587 buildings including 100 route miles through the London sewer system.

Geo offers dark fiber and conduit throughout the island of Britain with a foothold over in Dublin. Their network spans 2,100 route miles hooking up 587 buildings including 100 route miles through the London sewer system.

It will complement Zayo’s extensive London metro fiber network quite nicely, giving Zayo fiber access to and within the other major metro areas in the British Isles. They will go about adding more lit services from here no doubt, as well as building out more fiber as usual.

Last month Zayo agreed to buy Neo Telecoms, giving it a Paris metro footprint plus a regional network with data centers sprinkled around France. Next up, I’d have to be looking at Amsterdam and Frankfurt.

Financial terms were not disclosed, so we can’t be sure of the valuation Geo managed to get. However, we’ll surely hear more about that in July if not in an SEC filing sooner.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Mergers and Acquisitions · Metro fiber

As far as Europe goes, this is a pretty big deal.

That’s poorly phrased. What I mean is that even though we’ve gotten used to lots of acquisitions, this is still a big deal.

What makes it interesting? Zayo has telegraphed this strategy for multiple quarters. The question will be, will the zayo playbook in Europe be the most talked about topic on the filed for roadshow and why colt and level 3 didn’t participate.

I think it’s certainly not a surprise for those of us that follow such things. But I do think Zayo’s growing footprint in Europe and aggressive business model are going to have longer-term interesting effects on the way the fiber business evolves over there.

No need for Level(3) to participate. They have a massive fiber footprint via the GC acquisition

It seems that you’ve begun to answer your own question.

The answer to my first question(on the roadshow) is more trivial than anything of consequence. The second question is obviously unresolved but important and I would say the only thing this deal changes is the timing of more consolidation.

The key question I have for this group is who are those at the final table. I believe the last public statements by Zayo was that the European consolidation opportunity wasn’t nearly as vast as the US(called it a handful of names).

Other than Colt, who else is in this critical handful? Digiweb, Versatel, euNetworks, Interroute and what types of multiples would those asset types demand in a sale?

Don’t forget that while the opportunity is certainly quite different in Europe, it in Zayo’s interest to play things down. Other players could include Relined in the Netherlands, IP Only in Scandanavia, LinxTelecom to and in the Baltics, SurfTelecoms and SSE Telcoms in the UK, Inexio in Germany, Fiberlac in Switzerland. There are others. Not as many as in the US, but others.

http://www.sec.gov/Archives/edgar/data/1502756/000150275614000026/tladd-onandgeoacquisition8.htm

The only trade rag with an estimate I saw had 12mn in ebitda, did Zayo just pay 14.6x?

Based just on recent history, I would be very surprised if the multiple even approached that number.

This source estimates 2013 EBITDA at GBP13M http://megabuyte.com/free2air/13883/alchemy-hopes-turn-geo-networks-gold If true (and it’s not definitive either), that would put the multiple somewhere between 13-14.

zayo s1 filed: http://www.sec.gov/Archives/edgar/data/1608249/000119312514259283/d715611ds1.htm