Speculation on who will step up and buy tw telecom has been spreading, with the latest being a Bloomberg article quoting various analysts bullish about the potential of a deal. The candidates cast in the role of buyer are TW Cable, Comcast, and CenturyLink, and I agree they are the most likely if one accepts the hypothesis that tw telecom is preparing to sell. But I’m going to go out on a contrarian limb and say that not only will they not sell, this time they’re going to buy.

The case for buying tw telecom falters on the question of valuation and the premium to be paid. In order to buy the company, a suitor has to either have a huge pile of synergies at hand or believe they can operate the assets in a superior way. And in order to pay a substantial premium to tw telecom’s already leading valuation, one probably needs both. Wanting to own the assets and having the resources to overpay isn’t enough to make the case.

The case for buying tw telecom falters on the question of valuation and the premium to be paid. In order to buy the company, a suitor has to either have a huge pile of synergies at hand or believe they can operate the assets in a superior way. And in order to pay a substantial premium to tw telecom’s already leading valuation, one probably needs both. Wanting to own the assets and having the resources to overpay isn’t enough to make the case.

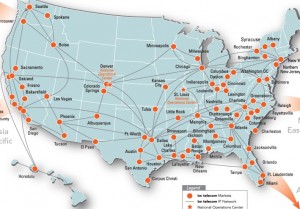

But unlike many of the metro fiber consolidation targets out there, tw telecom is neither in need of more capital or a new business plan. They’re at the top of their game relative to the assets they have in the ground. Those assets are powerful, but they aren’t necessarily the most extensive or the newest or the most strategically placed. The magic of Larissa Herda & her team is that they make real money for their shareholders off those assets nonetheless, growing steadily all the while despite economic storms, regulatory shifts, and the inevitable product cycle from cutting edge to legacy.

That’s why I believe that the growing talk of finding a suitor will inevitably point in the other direction and pressure the company to do more with the operational capabilities it has demonstrated. Rather than find a suitor who knows less about making money off this type of fiber than they do and convince them to pay a premium, the conservative management team that leads tw telecom must inevitably see the other side of the coin. A strongly valued, well operated business that has proven that it knows what to do with fiber can make much more money if it has more of that fiber.

Yes that means fixing someone else’s nightmare sometimes, as one industry executive described M&A to me last year. And yes there’s risk involved, but when isn’t there? And it’s not true that tw telecom has been completely absent from the consolidation of the past three or four years. They’ve been there at many of the auctions, including the one for AboveNet. They just weren’t ready to bid high enough. It has been argued that the current management team is not fitted to an inorganic plan, but I would argue that they may be less likely to bid but they’d be more likely to integrate purchased assets thoroughly and correctly.

The recent attention means that right now tw telecom’s stock price is at levels not seen since 2001, which could be used as currency. Along with still very favorable debt markets and the benefits of the recent balance sheet refinancing they did, they’re in a position to make a big move should the opportunity arise. A better position, I think, than their supposed suitors are to buy them.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Mergers and Acquisitions · Metro fiber

Intersting take.

On “fixing someone else’s nightmare” unless they want to stop their industry-blessed strategy for next few years without alienating current base they would need to buy mostly fiber and reach. Not new network arcitectere or new customer base. And there just aren’t that many of those left out there.

I would say they stayed ahead because they didn’t have to put everything on hold to do that like their peers who most focus still on how cheap they get access lines.

It could also be that they are not interested in buy or sell. Maybe the recent flurry of loose-lips analyst commentary is a concerted effort to bully them into doing one or the other? Even with good trak record, The Street surely see bandwidth commoditization is inevitable. They not embraced that idea or expressed much interest in adjacent lines .

Alright Rob, the follow-up is what do your tarot cards tell you as the target?

Do all roads still lead to XO? From what’s been reported about that asset on this board – it seems less likely than in times past.

Sidera seems off the table but how do you handicap others like DukeNet(who donna mentioned there is a book out on) or even a merger candidate and a public listing for Zayo?

Could they do something internationally?

Hmmm, a subject for another day I think!

They did a substantial borrowing in Q412 and are still sitting on this in cash.

I thought that was used to retire higher interest debt and stock buyback, which is continuous with them?

Respectively disagree with your view. I do agree twtelecom is the best wireline telecom property in its class – no one close to it. Their steady addition of fiber fed buildings continues unabated and organic sales into these buildings continues to grow. However, the time is approaching where the value of these assets and sales will be reaching its peak. So who needs twtelecom? Time Warner Cable does – cord cutting, video just being a bad business (NFL and ESPN are the only ones making big money) and continuing competition from satellite and FiOS, etc. places vast importance onto the business segment. While Time Warner Cable has done well in this area it hasn’t done as well as a Cox Cable or Cablevison. Even Comcast Business is beginning to over shadow Time Warner Cable’s efforts. It’s time to reunite the two companies and focus on commercial business Internet, Voice, and Ethernet sales – with twtelecom they would instantly become the primary competitor for both Verizon and ATT across the country and would be very tough to beat in the marketplace.

RESPECTFULLY you are an idiot and should shut your man pleaser because you sound like an idiot everytime it yaps.

Relax there buddy, this is a professional forum. We’re all just posing our best guess. I still believe the fiber “wholesale” deals are good move. TW recent releases say they are doing instant service activation and BOD, that needs a simple and single architecture all around which they are happy to tell you about at every chance (I am a customer). If you buy another network, all of a sudden is harder because the new network is not the same. If you just buy fiber, you can overlay your own network on top of it and still do the dog and pony tricks and sell your current portfolio. So in this far fetch dream where they are the buyer it would be mistake to buy XO – that company is total wreck and they would devolve by a couple years trying to get it back to normal.

I think XO is a unlikely target unless the price is very low. The company is a mess and this is a known thing among people who work in the industry. Wasn’t always this way but has become dysfunctional over time. It would have to be largely gutted to be of any value to tw. I don’t want to see that because it’s bad for XO employees. XO has many non standard and frankly just cheesey networks that tw will never consider period. The hardware they use is largely outdated and configurations have been put out based one price only so they could get any business regardless of what value they provided them. Hardware can be replaced and networks enhanced but that will be a huge capital investment.

x2

Agree, XO’s only value to TWTC is the fiber between markets, maybe a few added POP’s for new market reach, and some 100G if that’s actually been widely deployed (which I doubt). If they did and I were them, I would literally be looking for somewhere to just dump most of their accounts, business, and employees to someone who would manage it and TW try to absorb the assets they need only. Just do not think that is very doable.

XO’s fiber between markets is basically Level 3’s long haul network if I remember correctly. Wouldn’t it be easier to just pick up some dark fiber and call it a day then try and absorb that train wreck.