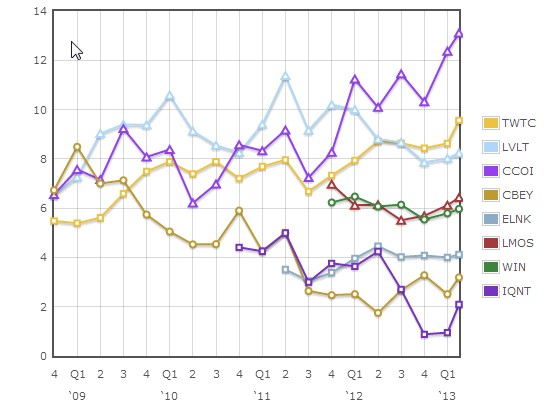

Since the end of the first quarter, there have been a few signs of life among relative valuations for competitive network operators. The chart below, which has been updated for both Q1 and shifts in stock prices since, shows nearly all of the operators tracked seeing higher EV/EBITDA ratios since the start of the year. But the real wonder is Cogent, which is now trading at a stratospheric 13x its annualized EBITDA from Q1 .

That’s easily the biggest number I have seen since I started tracking the numbers, and it comes despite few if any takeover rumors and even less press from the company beyond earnings and appearances. Since the financial deep freeze of 2008 Cogent’s stock price has been on an amazingly consistent upward trend, quietly shrugging off all obstacles.

EV/EBITDA for Competitive Network Operators

I have updated all the companion plots as well, which you can reach anytime from the Competitive Telecom Trends link in the Resources section – or from the links below. I transitioned the Capex/Revenue plot to a trailing 12 month view a few months back, which makes it much more readable. The number of active, public companies on this plot has been shrinking. Any opinions on who I should add to those tracked? Alteva? HickoryTech? GTT? Consolidated Communications? CenturyLink?

| Valuation: EV/EBITDA |

EBITDA Margin |

Capex/Revenue |

Revenue Growth |

| (EBITDA-Capex)/Revenue |

Net Debt/EBITDA |

Revenue/Employee |

EBITDA/Employee |

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: CLEC · Fiber Networks · Financials

Given GTT’s recent acquisition of Inteliquent, I’d definitely say that they should be added.

Agreed, I’ll hunt down the data this weekend. But they didn’t buy Inteliquent itself, just the former Tinet piece!

and did that acquisition make Inteliquent irrelevant for the above?

I’d be interested in seeing info on European companies, and maybe whatever public info is out there for European subsidiaries of American companies (LVLT, Zayo, etc.).

Hmm, you mean add Colt and euNetworks perhaps? Sounds like a good idea actually. I don’t think Interoute puts out enough quarterly data, though I suppose I just don’t know where to look.