Now that the world hasn’t ended, the next long cycle of the Mayan calendar has begun, and everyone’s getting ready to listen to way too many versions of ‘Auld Lang Syne‘, it’s time for a few predictions about what’s ahead for telecom and fiber M&A in 2013. Not ‘things to watch’, ’emerging trends’, or other wimp-outs, but actual predictions that people can laugh at next December if they can outperform the modern attention span. After all, what’s a blog for if not to stick out one’s neck for no apparent reason:

Now that the world hasn’t ended, the next long cycle of the Mayan calendar has begun, and everyone’s getting ready to listen to way too many versions of ‘Auld Lang Syne‘, it’s time for a few predictions about what’s ahead for telecom and fiber M&A in 2013. Not ‘things to watch’, ’emerging trends’, or other wimp-outs, but actual predictions that people can laugh at next December if they can outperform the modern attention span. After all, what’s a blog for if not to stick out one’s neck for no apparent reason:

- Softbank’s deal for Sprint/Clearwire will go through, but not intact. In the first half of 2013, the deal will be caught in a crossfire of lobbyists worrying about excessive spectrum holdings, foreign ownership of national infrastructure, and just plain sour grapes from AT&T and DISH. The FCC and DOJ want a third competitive alternative, and Softbank/Sprint will offer concessions to give them the cover to approve. They’ll divest some of the Clearwire spectrum, and they’ll commit to selling the wireline business.

- Zayo will slow down and buy just three companies whose names will probably all begin with the letter F: Making up that list will likely be FiberLight, Fibertech, and FPL Fibernet. With the new depth in the Northeast and Florida, as many on-net buildings as tw telecom, and more intercity and regional fiber, they will then declare victory and prepare for an IPO in 2014.

- Level 3 Will Buy Colt – Yes, I’ve talked about this one before. However, it was a hypothetical that wasn’t ready to happen yet while the Global Crossing integration was young. In 2013 with much of the GLBC heavy lifting over, making a play for Colt will become the obvious next step. Level 3 will focus on higher organic growth in the Americas while taking advantage of low asset prices in Europe before the economy over there figures out how to find its ass with both hands.

- CenturyLink will buy a national fiber footprint, but it won’t be tw telecom. Rumors to the contrary, I don’t think they’ll find a price they can agree on. CenturyLink will instead turn to XO or Sprint Wireline (see prediction #1) to boost its national enterprise depth at a more affordable multiple. There will be more talk about CenturyLink/Level 3 but that won’t pan out either.

- Lightower/Sidera Will Merge With DukeNet – The private equity guys behind the pending Lightower/Sidera deal will look to adjacent territories with assets backed by other like-minded private equity guys that are willing to team up. Sidera was already looking to the south with big Virginia buildout plans, and talked about the Carolinas. DukeNet, which has been half owned by Alinda Capital Partners since 2010 is an excellent match, and will get their deep regional coverage all the way to Atlanta.

- Tata Will Buy Inteliquent – After getting outbid by Vodafone for C&WW, Tata has the chance to gain scale in the IP transit and Ethernet businesses, add whatever the tandem voice business’s cash cow looks like next year, and simply expand their presence in both the US and Europe by picking up Inteliquent – which is looking at a rebuilding year after a difficult second half. I think Tata will not pass up the opportunity to make a play for them.

- Dish will do some sort of deal with TMobileUSA – Once it becomes clear that Sprint doesn’t need them and the Feds won’t stop Softbank, where else are they going to go to turn that spectrum into something other than a regulatory football?

Ok, that’s it. I’ll be 90% wrong of course, but that last 10% I promise to gloat about for years. Do you have any predictions? Or would you just like to aim a flamethrower at one or two of mine? Leave a comment, and then have a Happy New Year!

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Fiber Networks · Internet Backbones · Mergers and Acquisitions · Wireless

How about Pacnet? Telepacific, Earthlink and Windstream? I agree on likely targets for zayo but I think Dan will do more acquisitions than three. Finally I don’t think XO gets sold in 2013 though when Icahn wakes up and finally sells I see lvlt as a player given the fiber iru synergy.

Just because i didn’t come up with a specific guess doesn’t mean I think Pacnet, Telepacific, Earthlink, or Windstream will stay pat. It just means I’m not ready to guess just yet. Put Integra Telecom in that camp too.

Forgot one. I suspect NTT will do something inorganic in 2013. Look for deeper presence in North America by way of transaction.

I think they could and probably should, but may not be ready to pull the trigger yet.

I think you’re right about Sidera/Lightower taking a stab at Dukenet; I’ve always thought it should have been a bigger target considering the growing tech and financial importance of the Carolinas and if they acquired Dukenet, they’d have one of the deepest fiber reaches on the eastern seaboard. I personally think that with their private equity backing, they’ll also take a stab for one of the Florida companies, so I don’t think Zayo gets both, but I agree – I think next year will be very fun to watch!

Rob, I truly enjoy your website and your editorial comments are usually on target. However, I think you might have missed the mark a bit on your 2013 M&A. I agree SoftBank/Sprint will get pressed to sell off some spectrum, but where would the logic come far in requiring they sell the wireline. They may choose to do so though. Zayo may find Fobertech attractive, but I don’t think the other two F companies are likely. They have had their chance to swing at one and the other is small part of a huge energy company with no motivation or desire to sell. I agree Lightower/Sidera will make a purchase if Zayo and the investment banks actually allow them but I don’t see it being DukeNet. It is always entertaining to contemplate M&A though. Happy New Year!

Well, missing the mark is what making specific predictions is about – at least more than half the time. Your thoughts also have merit, we shall see.

Former xo exec,

The US govt has intimated before that it might not let a national wireline go to an overseas buyer even one as friendly as BT if memory serves. My questionfor you would be what you think the end game would be for xo. My working hypothesis has been lvlt in 2014 but wouldn’t count out a windstream and maybe an outside chance w ctl. How would u rank order suchfun?

Rob, look for Century Link to buy Windstream.

I will certainly keep an eye out, though I’m not willing to go out on that limb just yet.

Great read, thanks! A great place to discuss and rate M&A ramblings is http://www.merjerz.com/. Add you ideas, vote on others, and support the best deals to make them happen!

Power to The Powell at Telecom Ramblings for such great predictions! Happy New Year, Rob, and may yours be a great one in every aspect of life! 🙂

Dave Rusin, former AFS CEO reappears in telecom …

Suprised that Cogent was not on your list anywhere… seems like they need to merge with someone.

On a different note, Limelight?

lvlt will buy llnt.

I meant lvlt will buy llnw(not llnt as I mistyped/said earlier), I suspect it is why they are keeping their PHX office as a hub. But who knows, it would certainly be more interesting than Colt.

It’s certainly possible, but I’m not sure why it would be more interesting than Colt! 🙂

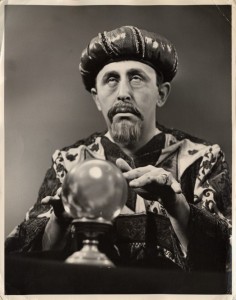

Where is the picture of this fortune teller from?