For those who thought Zayo Group (news, filings) was done shopping for the year, the word is ‘nope’. This morning the rapidly expanding fiber phenomenon announced an agreement to buy First Telecom Services for $110M, it’s sixth deal of the year. The purchase is expected to close by the end of the the year, and will be funded by Zayo’s current cash on hand.

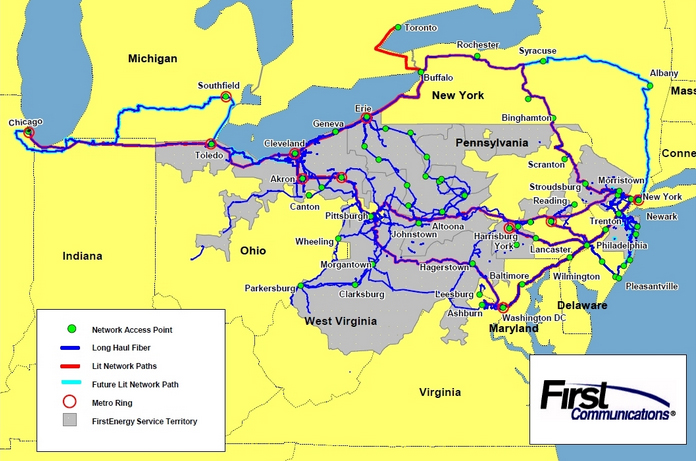

FTS operates 8,000 route miles of network hooking up 500 buildings across the Northeast and Midwest, but mostly in Ohio and Pennsylvania. They have been moving into lit services, but most of the revenue is currently from dark fiber IRUs. Parts of Zayo’s backbone run on dark fiber IRUs from FTS, and today’s deal will give them full control over that part of their network. Along with the backbone routes come metro networks in Chicago, Akron, Cleveland, Toledo, Youngstown, Southfield, New York City, Northern NJ, Reading, Washington D.C., Erie and Harrisburg. All in all, the deal seems to be very complementary to Zayo’s other assets across the region.

FTS operates 8,000 route miles of network hooking up 500 buildings across the Northeast and Midwest, but mostly in Ohio and Pennsylvania. They have been moving into lit services, but most of the revenue is currently from dark fiber IRUs. Parts of Zayo’s backbone run on dark fiber IRUs from FTS, and today’s deal will give them full control over that part of their network. Along with the backbone routes come metro networks in Chicago, Akron, Cleveland, Toledo, Youngstown, Southfield, New York City, Northern NJ, Reading, Washington D.C., Erie and Harrisburg. All in all, the deal seems to be very complementary to Zayo’s other assets across the region.

FTS is the fiber division of First Communications, which also operates some CLEC services that don’t appear to be part of this deal. The fiber runs primarily along the energy rights of way of First Energy, which like many other utilities dabbled in the fiber business during the bubble. First is currently owned by the Gores Group [Edit: apparently not anymore…] First had recently been owned by Gores along with Alpheus Communications down in Texas which is not part of this deal either – yet anyway. There was talk when Alpheus was purchased that it would be combined with First Communications, but apparently Gores decided to take a different path.

While Zayo has been in the midst of the biggest integration it has ever attempted since the close of the AboveNet deal, today’s deal probably won’t have a big impact on that front as dark fiber assets are the easiest to integrate. Bank Street Group advised FTS on the transaction.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Mergers and Acquisitions · Metro fiber

I get the idea that Zayo has one more blockbuster deal left and then they will have become in a 5 yr period a dominant leading force in industry.

That move being XO.

I still dont belive their integrations are as detailed and as complete as other companies but still very impressive.

Using Dan Caruso invested captital model they will have with what $3-5 billion dollars built on the largest most complete fiber asset with depth beyond the normal CLEC in the USA. One woudl think that over time that investment is going to make some folks alot of money. Compare to a Level 3 15 year investment and M&A flurry a few years ago you simply have to say impressive.

What about a European acquisition – such as EU Networks?

Dan Caruso is part owner of EU Networks

What’s the most acquisitions any one company has ever done?

By my count I think this is 21-23 for Zayo and the most I can recall by any single telecom company.

This will be Number 23 for Zayo. If this one closes by December, that would be seven in the previous 12 months. Details here: http://www.zayo.com/company-history

Forgive my ignorance but isn’t this a lot to integrate? Especially in telecom where no one ever successfully integrates… (only sort of kidding to note that TW is still integrating GST and L3 runs 7 AS#’s, worldcom didn’t workout well, either). How are ops, sales, accounting, billing/rev rec, comp plans, etc no problem for Zayo while every other telco (and non telco) spends years and big resources to integrate & standardize?

Back to a question I asked a year ago – can anyone name a telecom roll up that created value (ex bankruptcy)?

If you are a competitor to Zayo planning a bid on an asset which is going through a process you have to be asking yourself whether the diligence is worth the effort if the bankers are going to preempt the process and sell it to Zayo. Conversely, operators considering a sale may decide to preempt the bankers and just call Zayo!

Agreed, yet this will catch up to Zayo so take cash if you sell and NO stock, Caruso will find a way to screw you. Trust me his own managers know this.

Interesting Zayo strikes again. Rumors are Rumors but is sounds like Fiberlight is being sold b a quiet sale.

I also heard a few players have offered big bucks to OCG as they are the last private player with a NYC Franchise as well as many miles of fiber and unique river crossings. May find out OCG was sold for as much as First Energy.

But who knows. Hope Caruso can keep paying the bills…Thats a huge nut he has to carry and alot of people will string him up if Zayo fails. Remember what happened to Mussolini.

Last question is when will L3 buy Zayo or Zayo buy L3? Or is it all just a plan where L3 bought long haul and Zayo buys the metro?

Only a crystal ball can tell and unfortunatly I lost the one i had!!

Regarding more consolidation rumors: I still do not get what the heck Time Warner is doing by not going after the fiber guys that are left standing. Unless the sell-out rumors of TW-CL are totally accurate, they must know that it would serve them well, and shake the foundations of US telecom if they strategically played in the sandbox.

They don’t really need anyone’s enterprise portfolio, they just need to pick up a Fiberlight or Light Tower or Sidera to vastly expand their footprint and forward pass into the other guys territory overnight. Adding that to their focus on high-end metro to the premise… why not? If anyone could comfortably pay for it and integrate more reasonably and believably, it would be them. When these other guys who buy overlapping footprints for sport say they are integrating, it just makes you laugh. “Check me out now” with a yardstick to your crotch is not integration, boys. Its just a contest.

I do my best to avoid making promisses I cannot keep. Since I do not have a crystal ball, I cannot promise what the future holds. Warren Buffett does not pretent to know how his investors will do over the next 3 years — and neither do I.

My promises are as follows. I will continue to manage the business as if we will own it forever. I will continue to be transparent, open, and honest with investors, whether specific data is good, neutral, or bad. I will care as much for my future investors as I do for my existing investors. That is, I won’t want one investor class to make money at the expense of another — but instead will want them to do well because of fundamental value creation that takes place while they are investors. Finally, I will maintain the view that I work for Zayo’s investors — and my job is to manage the business in a way that maximizes their return.

Our horizon is long term. Long term success requires customers be enamored with our solutions and service. Therefore, the goals of taking care of investors and customers are tightly aligned, not in conflict.

The key to taking care of customers and investors is the Zayo team. The team must be capable, motivated, and confident. They must feel they are being treated fairly, and that they are sharing appropriately when value is being created. It works best when team members respect and genuinely like one another.

I remind our team that we are first and foremost responsible to our investors — but I emphasize to excel for investors requires us to achieve a work environment that is great for employees. The starting point for enjoying work is being proud of the job we are doing for our customers. As such, enamored customers, employees, and investors are all essential to building a create company.

Telecom Wizard — if you want to chat any more about this, please drop me an email.

Public enterprise executives, employees and their shareholders would do well taking copious notes of your post.

You have accumulated the necessary thinking skills of a great business leader intent on spearheading capitalism to its highest heights, which at its core is predicated upon “service” and “serving” the needs of its “customers” with an undying yearning to please their needs. Needs that are both identified and perceived.

If there is one item or skill you haven’t identified in bringing a business enterprise to greatness, it would be your willingness to “sacrifice” in advance of everyone you have been privileged enough to lead.

Since you utilize Warren E. Buffett as an example, I might refer to salary in this regard.

With you being a “private company,” what are your thoughts there, Dan? Would you forgo your own salary or work below scale in order to motivate and inspire when necessary? Moreover, what about using your own money to invest in the enterprise in conjunction with placing your own “skin” in the game?

Great leaders “INSPIRE” and there is no greater way to inspire people then for them to see their leaders sacrificing especially “financially” along the way towards building to greatness. You have a partial “mentor” over at (3) who never acquired this skill called “economic sacrifice.” tia

One of the first things Dan tells the staff of the companies he acquires is that he doesn’t take a salary, he doesn’t even need to work. He just does it for fun. Then he brings up that there will likely be layoffs and those people can also not take a salary. You know, for fun.

well, CarlK, since you asked….

Since Zayo’s inception (and ICG prior), I have not taken a salary or bonus — and this will continue for the foreseeable future. I have invested a substantial amount of my own money into Zayo. To the extent I do well financially, it will be alongside equity investors, which include management through the management equity plan.

Thank you Dan. In a certain way, but a much more respected way tied to the telecom boom, you are reminding me of Mark Cuban for having been shrewd enough to capitalize on the mania which comprised the Y2k Bubble. If my assumption on how your wealth was attained is wrong, my personal apologies.

I do have another question; however. Is the Kiewit Construction Company one of your trusted partners today?

Although we haven’t seen eye to eye in earlier periods, the more I get to know you, the more I respect and admire you. Keep up the great work of inspiring others with your outstanding “VISION.”

I know you have been too busy to answer, Dan, but one of the data points or filters I had utilized early on for investing in Level 3 included the feedback I was receiving from friends on The Right Coast who ended up in construction, and how they described the Kiewit Engineering Brain Trust. Impressive would be an understatement for how they conduct themselves in business.

Overtime, The Oracle added to that confidence about the quality of their “communications network” specifically, even beyond his equity involvement in July, 2002, when I caught him on a video praising Walter Scott as “a great builder.”

We’re just patiently waiting for these “great builders” to finally morph into “great telecom operators” while delivering the mandatory metrics that the Wrong Street Crowd continues to Supremely Dictate must become “visible” before they pay up like they must and will “eventually.”

Can you imagine if your old Kiewit, Level 3 Alma mater came to “Mr. Market” with “shrinking revenues” along with yet to be determined “pension/union liabilities” like Century Tel(CTL) did yesterday, how their “stock” would react?

As a matter of fact, their stock is acting like they were the ones, not Century Tel, who was reporting “shrinking” top line revenues even into and through 2013 for those with a listening ear into conference calls.

You can prove that “Mr. Market” is a liar and a thief by watching the macro sell off and comparing it to the up micro move in CTL today. Got to build that collateral up for that CTL acquisition which they say they don’t need, but Wrong Street is DEMANDING. IMO

L3 doesn’t need Zayo, Caruso is still trying to catch L3 being he worked there.

Zayo is nothing more than a VC/Banking group investing in telecom waiting for a BT or other company to buy them. They really and I mean really could care less about their customers, we in the industry are all benefiting from this.

I would have to disagree with you on this. As a person on the front lines interacting daily with the customers I see a dedicated company that goes above and beyond for the customer. Customer satisfaction is what drives the company. Maybe from high on a perch where you sit it may not look that way and yes I perception is big but it just is not so.

Our goal at Zayo is to build a superb Bandwidth Infrastructure company. Our time horizon is very long term. With the support and help of Zayo’s employees, customers, and investors, I hope to be part of the company for decades to come. I know this will only be the case if Zayo delivers appropriate equity value creation to its investors, great solutions and service to its customers, and a fulfilling work environment for its employees.

To achieve our long term goal, we know that our customers need to be enamored with our service. We worked hard to get through the A+Z integration quickly, so that we could rapidly get to one set of systems, data and processes — as this is paramount to delivering great service. I am proud of how well the Zayo team did for our customers during this difficult migration. I am appreciative how quickly the Zayo team has transitioned to getting back into the day-to-day operation of the business. The proud tradition of Abovenet and Zayo — each known for providing great service to its customers — is being preserved.

From the nature of your post, you are with a competitor. Some of our rivals do an excellent job of providing great service and perhaps you are with one of them. Those who do need not bash others, as it comes across as petty and unprofessional. I believe those who deliver great service let their results speak for themselves.

If you comfortable contacting me directly, I would welcome your direct feedback and perspective.

Zayo’s rise has also benefited the industry. VCs are way more willing to invest in telecom. Lots of execs are openly borrowing from Caruso’s playbook (dark fiber, FTT, etc). It isn’t just luck.

If you have to work with them then you know how epically awful they treat their little clients as I’m one; maybe if you’re VZ or a big wireles outfit its different but pity the fool. the investment vehicle rings entirely true to me

I am sorry you feel like you are being treated inappropriately. Please contact me directly, and I will make sure your situation is fully shared with me and that we handle the situation appropriately. It sounds like you are extrapolating your situation into a generalization. Though I don’t know your situation, I suspect the situation is unique to you — not an indication of our relationship with other customers big, medium or small.

Dan

Nice PR coments but the truth is your company has screwed a lot of people in the name of $$$ Once your assasins finish then you cut their throats. Look what you did to john scarano and brad cheetle. Used and discarded like a napkin from your caviar dish.

Before anyone beleives the PR they want to see action. Look how your company has burned and pillaged Abovenet. Most of the people left took a huge pay cut and are working 3 positions. Now you fired Mike Brown. Many don’t like Mike but uyou copied his roladx and guess what. Threw him away like another napkin

The mass of Zayo victims is growing and doubtfullness in your ability is peaking.

I wouldn’t be supprised if this was a plan to borrow all this money. Buy all these companies then do an abovenet and run it thru bankruptcy

If so then you make Bernie Madoff look like a three card monte hustler

I don’t like that some people have lost their jobs post-acquisition, but that’s the telecom industry. I respect Zayo a lot, even if I hope that they don’t buy my company.

Exactly how would that strategy help current management? They are all out in bankruptcy, bondholders get equity. Are you stating that management is working on behalf of bondholders to bankrupt company?

Granted it (bankruptcy) happened so much in the late 90’s early 2000’s it did appear to be a strategy but it seems a huge stretch to assert this is their gameplan.

Especially based upon growth thru acquisition which always leaves behind a trail of discarded execs.

This is just an outsider’s opinion, and, full discosure, I love conspiracy theories, just not that one.

I dont really know Dan personally or professionally but I can say his tact in this forum far exceeds your sord of truth..He is coming on here to give updates and appears to be attempting to correct any issues that would have arisen.

I think you would be hard pressed to find any executive with decent tenure that hasnt been forced to make some hard decisions. This doesnt make them evil as you would imply.

Sounds like you cash a ZAYO paycheck each week.

Very obvious

Tough crowd. I admire Dan’s willingness to comment on this board. I don’t know anyone else in his position that would do the same. Seems like he is building something very special. Compare to L3, for example. Execution. Details.

Agreed parkite, thanks for engaging Dan.

I have to echo the comments of previous respondents that Zayo is priming itself for either a self-off or quick IPO and golden parachute for its executives. As an employee of Abovenet when they were purchased by Zayo, I was privy to learning things about Zayo that only confirm this belief for me. They claim they want the best and brightest employees in the industry, but do little to keep them. Upon acquisition, Zayo “didn’t rehire” 75% of Abovenet’s IP Engineering group, a group which managed an IP network 17.5x larger than Zayo’s before acquisition. They have no plans for overbuilding cable or shared bandwidth (ie. intercity) routes, even when such routes haves been exhausted. They supply their employees with a 401k but with no match whatsoever; they have no procedure or annual review for pay raises or promotions, and their hierarchy and organization is constantly in flux with employees getting moved around between organizations and managers.

As far as I’m concerned, the above points to a management looking to trim capital and overhead costs. I’ve heard Zayo presentations to investors where they claim former ABV employees are totally behind Zayo; I promise you they are not. I have not spoken to a single former ABV employee who is happy by their present circumstances. They have been met by arrogance and dismissal whenever a change to current practices is made. Zayo is Dan Caruso. This company is a grand achievement of finances and market vision; it is NOT a great place to work, nor a place that is being built for the long term.

The person behind the prior post is undoubtedly frustrated and disappointed. Our industry is consolidating. That this is unavoidable does not lesson the impact it has on the lives of certain individuals. It is part of the industry completing its journey to be a very healthy one.

Bandwidth is growing at 40-50% a year. Deep, thick fiber networks are the workhorse of bandwidth distribution. However, doubt still lingers about the financial merits of the industry. One of the reasons for lingering doubt is murky performance of current providers.

At Zayo, we believe in the long term and vibrant nature of being a Bandwidth Infrastructure provider. We have seen first hand how well privately funded fiber rich Bandwidth Infrastructure providers have performed over the past few years. We have also seen how larger providers – despite tremendous advantages of scale – have struggled to either perform as well or perhaps in being able to communicate how well their Bandwidth business is doing.

We believe that some of the overhang comes from business practices and beliefs arising during the meltdown. Some perhaps even date back to Bell System approaches. Some examples are (a) reliance on a complex set of OSS/BSS platforms with disparate databases (b) strategic views of dark fiber, infrastructure versus value added services, carrier versus enterprise (c) methodology on how to integrate acquisitions and (d) organizational approaches that separate revenue from cost/capital responsibilities.

Many from Abovenet, including the person who wrote the prior post, have different views. They wanted to convince us that their approach should be maintained. I understand this, as Abovenet built a great company. However, we were clear from the get go that our approach and beliefs will challenge conventional thinking. We would not delay integration execution by many months or quarters while trying to win people over. Nor would we revisit our reliance on Salesforce.com as an end-to-end OSS/BSS/database platform. We were clear that people either needed to go with the flow and dive in and help. Or they would be left behind.

We do our best to retain the best and the brightest. Cultural fit is important as well. We need a team that is dedicated and committed to helping achieve Zayo’s mission of being the leading Bandwidth Infrastructure company in the U.S. and beyond. Being best requires great service to customers, creative solutions, motivated and capable employees, and a commitment to deliver great financial results (i.e., equity value creation). We have found that some “best and brightest” want to be part of what we are doing…we also have found that some “best and brightest” aren’t comfortable with us.

Two of Zayo’s senior most team members — Ken desGarennes and Chris Morley — have never worked with Zayo executives in the past. At the next level down, many key executives either joined us from acquisitions or never worked with us prior. Jim Nolte from AGL and Rich Coyle from AFS are two great examples.

Zayo’s team are well known in the industry. They are creative, capable, and committed. They care about one another. They provided tremendous support to legacy Abovenet employees who wanted to be part of Zayo. They deliver great service to their customers. They are passionate about what they are building – a long-term leading provider of Bandwidth Infrastructure services. Moreover, Zayo employees are benefiting financially and through accelerated professional development.

Zayo has a 401K but we don’t match. Zayo also has a management equity plan that is shared with >50% of its employees, including many of the team that joined from Abovenet. Zayo also has a quarterly bonus and sales commission plan that is more lucrative than legacy Abovenet. Nearly 100% of all employees participate in either the commission or quarterly bonus plan. We believe in sharing with employees the value we are creating. We avoid entitlement-type compensation programs.

We do not have a procedure for ANNUAL review for pay raises or promotions. Raises and promotions take place on a regular basis throughout the year. We have given dozens of raises and promotions in the past 2 quarters. To us, there is nothing special about a calendar year. I believe annual raise cycles are old school and entitlement prone.

“No plans” for overbuilding cable or shared bandwidth is a ridiculous statement. This can be confirmed by looking at how much capital we spend and approve every quarter. What the individual might be referring to is that we more tightly link capital spending approvals to customer-driven business decisions. We don’t use the Bell-system approach of augmenting capacity based on unit forecasts. Instead, we have engineering resources distributed in business units & product groups – and we require a tight linkage with customer tractions at time of capital decisions. Product Groups are accountable for value creation – hence they are very aware of how spending is tied to growth.

Engineers with a business bent enjoy this. Some engineers don’t, as it more heavily involves product managers and sales in the timing and sizing of network augments.

Over the past years, Zayo has doubled in size every handful of quarters. So yes, our organization structure changes. We didn’t, however, change all that much from an organization structure when combining with Abovenet. However, from the eyes of legacy Abovenet employees, it must have felt like enormous change. We are fine-tuning the initial post merger structure – this is to be expected. Much of this is in response to feedback we receive from our organization – whether legacy Abovenet or legacy Zayo.

Trim Overhead? Yes. Fiber / Bandwidth Infrastructure is a scale business. This implies higher EBITDA margins as you get bigger and more efficient. Consolidation will happen in this space – and if you desire to survive and thrive, you must deliver great service AND show great margins. Anyone who fails at either will not survive. To think otherwise is naïve.

Trim Capital? With capital, we look to spend it wisely. We already spend a lot. In fact, we were much more aggressive than Abovenet in areas like Fiber to the Tower and customer driven fiber builds. If we can spend more and know it is creating value, we will increase spending.

Zayo moves very aggressively on integrating. We have an integrated OSS/BSS built on Salesforce.com’s platform. We move an acquired company’s data into our instance as quick as we can, which allows the combined company to operate as one. We are convinced this is the best way to integrate, and it is working very well for us. If you are a customer of ours, you probably have seen the benefit of this during the past several days as we have responded to the Sandy Storm.

This integration approach may not always feel good to those in an acquired company. We are upfront and honest about that we will be moving into our mode of operation. We emphasize that we will move quickly. It is not because we think our way is necessarily better in any particular area. We do belief strongly in one integrated platform. And we know the pitfalls of taking months and quarters to re-design around point systems and individual “best practices”. This might feel like we are being arrogant and dismissal. However, it is simply a practical reality of our need to move in a focused, disciple, and rapid manner. Our financial and service results are why we feel strongly about our approach.

Zayo is building a company for the very long term, by a large group of people who believe in each other and are enjoying their journey and accomplishments. Anyone who thinks otherwise is simply wrong.

Very nice honest post. As a company i like Zayo a lot and have been hoping to find a site to do business together. Thought i found one in New Orleans on Poydras but so far it looks like Southern Light has Zayo beat on staff in the area and ip transit pricing. Looks like Zayo still has a little more work on the network there that i cant wait around on.

Also props to your staff on the Sandy status updates on the Zayo webpage. Of all providers i saw with issues Zayo looked like it was doing the best job keeping everyone up to date, i would bet that may bring some customers your way as some may be jumping ship after issues that came up with their current providers.

Thanks Brent. I could not be more proud of Zayo’s teams response to Sandy. They were prepared. They reacted quickly to problem situations. They communicated exceptionally well with customers. We have received dozens (perhaps eclipsing 100) of communications from customers that echo’d your statement: “Zayo is doing the best job of keeping its customers up to date”. The customers cited transparency, pro-activeness, and network performance as huge positives. Our teams were a combination of legacy Abovenet/Fibergate and legacy Zayo — they worked together as one team, using one set of systems and data. I was primarily a spectator, but one who was in awe of how they handled the situation.

Dan, hats off to you for the post. Love or hate Zayo you can’t deny what they have done and Dan’s vision to do it. (Whether you like the vision of not) One day maybe i’ll peak under the tent and try working there for a while…

Companies doing acquisitions have to lay folks off…that’s just the way it goes. When a company like Zayo makes 20+ acquisitions…it’s not personal. It’s just business. It stinks to be on the wrong side of that equation but it is to be expected.

That said, bitter diatribes against Zayo might prove more that Zayo made a good decision in those choices. Acquired people who still want to cling to the old and not embrace the new…there’s the problem.

Wow. You guys should really think of a new beverage you could make with all these sour grapes!

Charlie M.

I re-read my post and can see how my wording could be read as disrespectful to many Abovenet employees who lost their job. You are right. I apologize. Abovenet had a loyal and capable work force, and were solid operators. In many cases, employees were impacted because of the need to eliminate redundancies and standardize on a single set of systems, processes and data. I did not mean to imply that employees that were affected somehow fell short from a perspective of cultural fit, capability, expertise, or work ethic.

I am unable to respond point by point to your email. Your comments on service quality and “not-Worldcom” were appreciated. RE the rest, I would respectfully appreciate it if considered the following.

First, Zayo believe that the past ~3 years was the time to consolidate fiber networks. We believed if weren’t successful in doing so, others would and Zayo would be left with a partial platform and the need to eventually sell ourselves. As such, we moved fast and aggressively.

Second, we are committed to building a long-term leader in the Bandwidth Infrastructure sector. To successfully accomplish this mission, we must offer great service to our customers and a solid returns to our equity investors. Success requires a capable, committed, and proud team. Such a team grows out of an environment where employees believe they are being treated fairly while, at the same time, have a sense of great team accomplishment. That is, employees need to feel they are building a great company that is providing compelling solutions and great service to their customers – and solid financial performance for their investors. Customers, employees, and investors – all need to feel they are being taken care to build a long-term viable company.

Third, Zayo is a collection of people who come from a wide range of telecom and Internet companies. Though many of the employees have known each other for a short period of time, the experiences they have been through together make them a tight knit group. Some of those who seem to be “insiders” joined us fairly recently, often through recent acquisitions. We are still gelling as a team, and evolving as a culture. Cultural fit matters a lot to us – we are climbing a big hill and we need for all of our team to be up for climbing it with us. We need a team of people who have each other’s back.

Fourth, our team consists of experienced and capable operators. They have deep experience at all facets of telecom from a product / service layer perspective. They’ve worked in companies that focused on Intercity as well as Metro; large cities as well as small; colo and dark fiber through to Ethernet and bundled services; carrier and enterprise. Zayo’s evolution followed a certain path based more on opportunistic acquisitions. Please don’t read this as me implying we are better than others. I am just pointing out that our experience set is broad, and our team is capable.

Fifth, we believe in transparency. This ranges from the day-to-day operation of our business, to our communications with customers and employees, and to our financial reporting for our investors. Customers observed this during Super Storm Sandy. Employees see this in the use of Salesforce.com chatter and during employee round table events. The investment community sees this in our financial reporting. Telecom Ramblings audience sees this in my ramblings.

Sixth, we are financially focused. Our goal is to build a value creation engine that runs for years and decades. Bandwidth (not revenue) will grow at 40-50% a year. Fiber will continue to be the workhorse of the Internet. Consolidation of fiber-based providers is creating an appropriate industry structure. These are great tailwinds. However, the burden remains on our industry to show how “production of bandwidth” leads to “sustainable and predictable creation of equity value”. Our industry still has a cloud hanging over it from this perspective. At Zayo, we work hard to (a) increase our understanding of where and how value is created and (b) develop methodologies to allow existing and potential investors to monitor performance. I feel we are making progress on both fronts, but with much work remaining.

I am fortunate to have achieved financial security. I choose to continue to work in bandwidth infrastructure because I believe I (through Zayo) make a positive long-term contribution to people’s lives. I believe Zayo helps its employees accelerate their career development while creating financial security for themselves and their families. I believe Zayo will create jobs (even after netting for positions impacted by consolidation), both directly in Zayo and through creating work for our construction and equipment partners. By doing well for our investors, we positively contribute to their livelihood.

I look forward to the end of the consolidation phase of our industry, because I know the harsh realities of consolidation negatively impact many people. Fortunately, the end of consolidation of fiber-based platforms is near. Post consolidation, steady growth and job security will be the norm.

I’ll echo one thing, as a non-management Zayo employee: my experience has been that the culture truly is tight-knit. People work hard and do their best to move mountains in large part because there’s a sense that we’re all in this together. This might be hard to believe from the outside, given how many different ways people have found their way to Zayo, but the people that I work with work hard and try to help one another as much as possible. People are more committed to this company’s success than to any other organization that I’ve ever been part of.

If Zayo is such a bad place to work, why is there a well paved trail leading from Level 3’s offices directly to their front door? My guess would be all the young and talented employees are getting sick and tired of hearing the same excuses and entitlement that Dan refers to from industry veterans. If you aren’t willing to change, then your company, your position, and your relevance will get swept under a mat and left as an after thought while the rest of us move forward in a profitable and productive manner.

Dan, while I admire your willingness to comment on this site and openly defend Zayo without hiding behind a screen name(which is great, I have no beef… in fact I buy quite a few circuits from Zayo)… you should probably learn when to zip it and not stoke the fire. Get a clue. Like the old proverb says – Arguing on the internet is like the Special Olympics… you might win… but you’re still retarded.

Certainly Dan isn’t going to convince everyone he engages on here, even if there weren’t sour grapes there are still very significant differences of opinion on how one should operate a fiber business. The point of Dan’s involvement in a public discussion like this is that he actually is involved and cares about it. He is not hiding behind a corporate wall of yes-men and boilerplate legalese, nor is he pretending there aren’t painful consequences to consolidation. That’s the usual response from far too many, whether in this industry or any other.

I don’t think he’s necessarily stoking the fire. As we saw with the almost endless XO layoffs ‘discussion’, it is perhaps *not* taking the challenge seriously that is more likely to do that.

Richard,

As the parent of a special needs child with an intellectual disability, I find your comments offensive and your behavior egregious. Yes I might be thin skinned about this type comment and such, and yes this is the internet so you can post what every you want, but you lose the respect of anyone reading your response. Life is hard enough without obvious difficulties, put yourself in someone’s shoes to have to live with a disability they were born with they didn’t ask for. Please consider how it would make you feel if it was someone in your family. Respect is the only “R” word you need to use and practice. It might just make you a better person.

Shut up hippy.

What is wrong with you? Special needs parents are the angels of this earth. They deserve our respect, not our cruelty.

I didn’t see this forum taking this turn. Let’s all play nice in the sandbox

It is amazing. The appropriate response should have been, “You are right”, or “I’m sorry” or even no response at all. Instead you show you lack of respect, lack of intelligence, and small mindedness be resporting to name calling. You also don’t know what you are talking about because I’m the farthest person from being a hippy that you can imagine.

This is just great reading. I love this stuff… Dan is a model for well thought out communication.

I worked at AboveNet but didn’t go through the turmoil of the merger, but I’ve heard from friends how horrible it is for legacy AboveNet employees. Good people –really good.

AboveNet was extremely successful, but that success never came out of White Plains. It was the Field who grew AboveNet to unheard of heights, and it was Joc Jacquay’s passion that provided the Field’s heartbeat. Dan will never reap the same reward because he places his value in other areas; namely non-living assets. If you could combine Dan’s determination with Bill LaPerch’s compassion –you would have one hell of a CEO.

It’s really simple; Dan Caruso has a Vision to build a dynasty of combined assets, and he doesn’t need anyone telling him what to do, or how to do it. Dan certainly doesn’t need anybody discussing their own vision –that would be considered whining. He wants to go from A to Z and roll over anyone who gets in his way. People who have that kind of mission either don’t realize the dissonance they create, or they just don’t care. Either way, empathy is for the weak and it’s just how they do business.

Bill LaPerch is a good man, but it was his failure in keeping pace with the growth that caused this debacle. Bill and his newly appointed COO tried their best to strike up M&A’s, but neither had the skillset to bring them to fruition. Taking us beyond organic growth was the key –and moving us to the next level failed. The Board was done, and soon after –the company. Dan did nothing but take advantage of the situation and the end result is what you see now. My hat is off to Mr. Caruso, but only for the ability to come up with that kind of capital. That was very impressive.

Just like war, spoils go to the conqueror and the conquered conform, or else.

Dan earned this and it’s his vision and rules to abide by now. If you can’t see or follow that vision –find another home. And for those who lost your job, depart and go forth. Hold your head up high and find a place where you can speak your mind.

IT Professional, the sharing of your earlier experiences at what became AboveNet was very interesting as well as enlightening.

http://en.wikipedia.org/wiki/Above.net

Without discounting “living assets” too much inside of the business organization–I enjoy people more than things–do you believe it is fair to say that Dan’s vision for placing emphasis on “non living assets” may be more appropriate inside of the communications paradigm where constantly advancing technologies will continue to displace people vs. “automation”?

This metamorphosis taking place right before our very eyes including evolution towards machines freeing up peoples time, will continue unabated long after Dan Caruso is gone………..Where the human species goes from there, is more scientific than not.

CarlK, Interesting observation. Beyond the traditional telco demarc is becoming more automated. You can see that with the Cloud and moving from a physical to virtual environment. Anything with the word “Virtualization” could mean eliminating jobs. However, the “living asset” I was referring to was only financially focused -while Dan is here:)

I’m still waiting for someone (Rob??) to identify to me a leveraged telecom roll-up that worked. We are all familiar with the (ahem) issues encountered by WCOM and the L3-WilTel-BRW acquisition machines, not to mention all of the others that wound up in BK. so: how does Zayo “integrate” acquisitions in days where others fail even with years and how does buying assets, adding leverage and firing employees add value? Isn’t newco just a re-hash of Abovenet with more debt and less expertise?

Dan, besides the Kiewit question, I never asked you and you never mentioned, or maybe I missed it overtime, but how much of Zayo do you control as a result of SPEARHEADING this great privately built ENTERPRISE throughout America? I applaud you for going BEAR or is that BARE on your “SALARY” during the “BUILDING PHASE” into maturation.

Additionally, as I have opined before on this board, you are very lucky that you are building this enterprise outside of the dubious control of Wrong Street and their criminal IB EMPIRE, but if you were allocating your “hard earned capital” to one or any of this “century’s” great internet/telecom companies inside of the public stratosphere, today, which ones would they be according to tying it to your important measuring stick for determining “dirt cheap” or “unrecognized value”?

I have always taught Youngins around me that, if you want to be great, hang around with great people. That applies to “focusing” on one’s particular areas of interest where passion lies, so please don’t be humble in your response during our day of rest. TIA!

In CarlK speak – I would be allocating my capital in Level 3, where the intrinsic value gets more bang for the buck. WRONG STREET will get it right – so says me and my side kick Charlie Munger. And I ain’t no Warren Buffet, I’m just a Canadian Buffet of the North – Parsod & Prem.

If you are looking to cross the T’s and dot the A’s, look no further than AT&T to connect to dot com industry – telecom Warren Buffett (the natural snowball consolidator) …. Walter Scott LVLTwaylong

Carlk, despite the fact that it’s privately held Dan’s share of Zayo is a matter of public record, you can check out their 10K from September (page 80) rather than making the man brag too much. In short, he owns 22% of the common and 1.7% of the class C preferred (most of which is owned by the company’s private equity backers).

Thanks Rob. 🙂 Although with Dan being derived from The Buffett Bosom, it is doubtful that he cares to brag since he knows that it’s all a “LUCKY LOTTO GAME.” A game where those fortunate enough to be granted with creating or accumulating the powerful tool called “MONEY,” may experience more “FREEDOM” than others. Not always true, but oftentimes more true than not!

http://finance.yahoo.com/blogs/off-the-cuff/warren-buffett-213923494.html

I am still interested in his “TELECOM PICKS” dangling around the “PUBLIC MARKETS” and being priced by “MISCREANTS” most of the time. 🙂 I am talking about the ones that are TOO BIG for Dan and his financiers TO BUY, so that he doesn’t attract any more attention during his hunting spree out on The Savannah. 🙂

Consolidation is necessary in telecom because organic sales growth is almost non-existent. And more consolidation is necessary because they can’t find their assets. No joke. Most of these roll-ups fail because the synergies never map out, because domain knowledge is let go, and because disparate systems can’t or won’t talk to each other. Also, companies that focus on employees usually win. See Zappos. Happy employees mean happy customers. When I see a comment like this: “I will maintain the view that I work for Zayo’s investors — and my job is to manage the business in a way that maximizes their return.” I can count down to disaster for everyone but investors.

Blah Blah Blah, Zayo fired too many people.

Blah Blah Blah, Zayo does not care about employees.

Blah Blah Blah, Zayo does not care about customers.

So… all true.

Thank you Dan for publicly sharing your thoughts and strategies. You have provided me as well as all of your competitors a place to point customers and prospects to see that Customers are not your #1 priority.

I was at the first AboveNet Alumni gathering this evening in Chicago. One smart person their made a point that hit home. “This is all Bill’s fault.”

That is right, Bill “the fish” caused all of this. He lacked the drive and vision to stay on top.

We can complain about how Zayo runs their business but we cannot blame Zayo for buying AboveNet. That is all on Bill.

I just came across these comments as I was searching for information on Bill LaPerch, whom I worked for at AboveNet. I was searching for Bill to see what he will be up to next and I hope he lands somewhere soon as I would love to work for him again, anywhere. He is a man of honor and integrity who truly cares about his employees. As a matter of fact, he made a job of helping those who were let go during the Zayo merger find a job. So many former co-workers said he was working the phones trying to help them find a new job.

“Blah blah blah” blamed the whole acquisition of AboveNet on Bill- NOT TRUE. Bill served at the discretion of the Board of Directors and it was their decision to sell the company and if Bill had not sold it, the BOD would have found someone else to do it.

Someone posted earlier that a combination of Dan Caruso and Bill LaPerch would make an excellent CEO and I agree- Dan is really smart when it comes to finance and M&A, but he is not so great with people. Bill cares about his customers and employees more than anything, he is the type of guy most employees would follow anywhere and many are waiting and hoping he lands somewhere soon so they can join him.

Bill grew a company out of bankruptcy and sold it for $2.2B- do not discount his business savvy.