This article was authored by James Henry, Senior Managing Director of Bank Street Group.

As we’ve spoken with industry executives and private equity partners over the past week since Zayo’s acquisition of AboveNet was announced, there have been a number of common questions and themes about the transaction itself as well as the implications for the sector:

- Was the AboveNet-Zayo deal a surprise? Dan Caruso has had AboveNet in his sights for years and the company was reportedly one of the cornerstone target opportunities that was identified for prospective private equity investors while Zayo was looking to raise capital for its acquisition war chest. The only thing surprising about the AboveNet deal was the speed with which it apparently came together. Dan Caruso and Bill LaPerch were featured together on the CEO keynote panel at Metro Connect on February 28th during which Caruso infamously pulled out his wallet and dropped it on the table to underscore the fact that he had raised additional equity. The two executives were also seen meeting privately during the conference. To get from that point to an executed Merger Agreement in less than a month is quite an achievement.

- What do you think about the valuation of the deal?

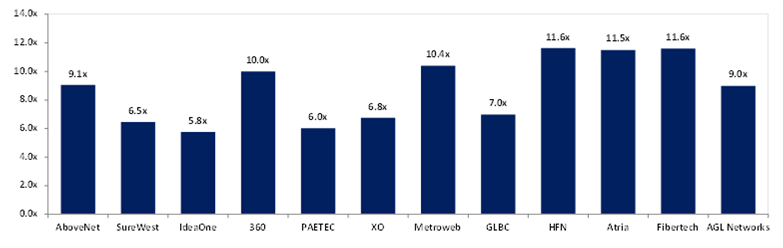

$84 per AboveNet share translates into a total enterprise value of $2.2 billion that is equal to 9.1x AboveNet’s estimated 2012 EBITDA of $240 million and 9.7x 4Q11 annualized EBITDA of $224 million. This multiple is lower than the double-digit level that people have always expected for AboveNet in a change of control transaction and lower than the headline multiples of other large-scale transactions such as 360networks, Metroweb, Atria Networks or Fibertech Networks. It’s certainly in the fairway of past transaction multiples, but not at the high end as we would have expected for the company that we have always believed has among the best sets of metro fiber assets in the U.S. It is probably not coincidental that the $84 per share falls precisely at the mid-point of the range outlined in the February 23rdproxy statement filed by Corvex Management LP, which stated “Assuming Bloomberg Consensus 2012 estimated EBITDA of $240.6 million for the Issuer and an acquisition multiple of 8.75-9.50x 2012 estimated EBITDA, an acquisition multiple in line with precedent transactions in the industry, the Reporting Persons believe that a price of at least $81-$87 per share could be achieved in such a sale.” It’s possible that AboveNet could have achieved a higher value in a broadly marketed auction process that opened up the bidding to multiple parties without the pressure of a 30-day shot clock. Competitive tension is always good for a sale process and something you typically trade away only for a truly pre-emptive transaction value. Of course, the passage of time would also involve execution risk and market uncertainty, so perhaps $84 was good enough to justify forgoing a more comprehensive process at this point in time.

It is probably not coincidental that the $84 per share falls precisely at the mid-point of the range outlined in the February 23rdproxy statement filed by Corvex Management LP, which stated “Assuming Bloomberg Consensus 2012 estimated EBITDA of $240.6 million for the Issuer and an acquisition multiple of 8.75-9.50x 2012 estimated EBITDA, an acquisition multiple in line with precedent transactions in the industry, the Reporting Persons believe that a price of at least $81-$87 per share could be achieved in such a sale.” It’s possible that AboveNet could have achieved a higher value in a broadly marketed auction process that opened up the bidding to multiple parties without the pressure of a 30-day shot clock. Competitive tension is always good for a sale process and something you typically trade away only for a truly pre-emptive transaction value. Of course, the passage of time would also involve execution risk and market uncertainty, so perhaps $84 was good enough to justify forgoing a more comprehensive process at this point in time. - Will another bidder emerge during the Go Shop period?

AboveNet is an asset that has been coveted by a large number of financial and strategic parties, so it’s conceivable that another player might emerge during the Go Shop process. We assume that larger strategics such as CenturyLink, Windstream, Level 3, tw telecom or the Cable MSOs would have significantly greater cost savings and revenue synergies than Zayo, but may be reluctant to step into an existing transaction with such a short fuse or to consider a multiple in excess of their own to win AboveNet.It’s also worth noting that a larger telco or Cable MSO might rather look at the pro forma Zayo a year or two from now when the AboveNet acquisition has been integrated. Folding AboveNet into Zayo simply creates a larger fiber pureplay that is likely to be sold at some point as opposed to combining it with an ILEC or RLEC in which case it would be gone for good. The new Zayo that will approach $500 million of EBITDA with synergies will be an asset that is much more relevant to an array of large strategics.We would be hard pressed to believe that a private equity firm would be able to challenge Zayo since a financial buyer would not have the same opportunity to enhance organic value creation with synergies. A number of private equity firms looked closely at AboveNet during the summer of 2011 and much more recently and were apparently unable to reach the valuation that was agreed upon with Zayo. The initial Go Shop period expires on April 17th and can be extended to May 2nd under certain circumstances, but Zayo has the right to match any higher offer for the company under the terms of its merger agreement. The Merger Agreement also contains a $45 million ($1.70 per share) break-up fee if AboveNet enters into an alternative acquisition agreement prior to the end of the Go-Shop Period. If the break-up fee becomes payable by the Company under any other circumstances the amount of the termination fee is $75 million ($2.85 per share). - What are the implications of this deal for fiber M&A?

The universe of potential acquirors of metro fiber assets continues to shrink as a result of the consolidation wave that has resulted in more than 20 acquisitions of broadband transport companies over the past 12 months. AboveNet and Zayo were among the companies most active in pursuing potential acquisitions during that period, so it’s obviously not positive for the competitive dynamics of the M&A market to have them come together and potentially to be out of the market for 6-12 months. Smaller players in the broadband transport sector will want to consider their own strategic relevance in the context of a shrinking number of potential buyers that now need to do much larger acquisitions in order to move the needle. Accordingly, we see the opportunity for consolidation between and among small and mid-sized companies that will establish larger asset bases and stronger competitive positions while enhancing value through synergies and creating larger entities with greater relevance to potential acquirers.For private equity investors, we see continued opportunity to invest in this growth sector. In the same respect that M/C Ventures, Pamlico Capital and Ridgemont have used the double-barreled strategy of strategic acquisitions (8 so far) and strong organic growth to create a business like Lightower with approximately $100 million in EBITDA in the past five years, we see the ability for other financial sponsors to emulate this model to fund both consolidation and organic growth. - What are the competitive implications of the deal?

Consolidation overall should be a net positive for many of the remaining players in the industry as there are simply fewer companies with fewer sales people in aggregate attacking the same large and fast-growing market for high-bandwidth connectivity. As we have seen with consolidation in prior cycles over the past two decades, this dynamic tends to have a positive effect on unit pricing in the market, customer acquisition cost, churn, etc. to the benefit of all.This transaction will certainly position Zayo as a much more formidable competitor by virtue of its enlarged asset base, product portfolio and sales force. To the extent that Zayo and AboveNet were viewed as competitors to larger carriers such as AT&T, Verizon Business, CenturyLink and Level 3 in the past, the new Zayo is likely to be a much more significant contender in the Carrier, Enterprise and Government markets going forward. Key questions will be whether AboveNet can maintain its strong sales momentum between today and closing 90 to 180 days from now and to what degree there will be distraction to the organization during the ensuing integration process. A number of AboveNet’s metro fiber competitors who we spoke with last week said that they feel the next 12 months might enhance their position versus both the buyer and seller during what they perceive as the inevitable post-closing disruption. - What will Zayo do differently with AboveNet’s assets?

Despite the remarkable growth in both cash flow and the corresponding market value that AboveNet’s management team has delivered over the past few years, there has always been a perception in the market that there is more that could be done with its extraordinary asset base by a larger player. While AboveNet has been very strong in the enterprise and fixed-line telecom carrier market, there are markets such as Wireless Backhaul in which Zayo has been aggressive while AboveNet has not been active at all. Dark Fiber is another area where Zayo has been more aggressive than many of its peers, so Zayo may look to more actively monetize AboveNet’s fiber inventory. - What will Zayo’s capital structure look like post deal?

Zayo is pushing senior secured leverage to levels not seen in precedent transactions in this cycle in order to finance the AboveNet acquisition with a smaller contribution of incremental equity. Consequently, Moody’s put Zayo’s ratings on review for downgrade on March 19th. Moody’s wrote that “The post-merger combined company will have greater scale, broader reach and wider capabilities. However, Moody’s estimates that leverage will increase by approximately 1.5x” which could put senior leverage above 5.0x EBITDA at closing. The pro forma company should have more than $400 million of annualized EBITDA at closing with solid organic growth. We believe Zayo could expect more than $60 million of synergies from AboveNet, which would put the pro forma company close to $500 million of EBITDA in the next year at their current growth rates. A fundamental driver of this combination is the belief that conversion of EBITDA to Free Cash Flow improves significantly with greater scale, so Zayo may have the ability to demonstrate to the rating agencies that it’s possible for a Broadband Transport company to carry leverage of this level. - How will Zayo integrate everything they’ve acquired?

AboveNet clearly presents a much more complex and extensive integration effort than Zayo has ever had to tackle previously. While AboveNet is Zayo’s 19th acquisition since inception, the vast majority of the companies it has purchased previously have been relatively small with a limited degree of complexity. AboveNet has more than 700 employees, operations in seven countries on three continents, a sophisticated product portfolio and complex back-office systems, so there will be completely different order of magnitude to this integration. - What is GTCR’s interest in the telecom sector?

GTCR has a history as a seasoned investor in the telecom sector and has made two significant communications infrastructure investments in the past two weeks. In addition to the undisclosed sum it invested in Zayo in connection with the acquisition of one of the premier set of fiber assets in the market, GTCR also committed $150 million to Telecom Lease Advisors in order to fund the roll up of ground leases beneath wireless tower sites. Private equity investors overall have been very active during the past two years in what we consider to be the three pillars of communications and data infrastructure: Data Centers, Fiber Networks and Wireless Infrastructure. While Data Centers and Wireless Infrastructure have attracted the strongest interest, the recognition of Broadband Transport companies as a compelling asset class continues to grow as investors recognize the strong secular trends behind the industry and the powerful operating leverage inherent in these asset-rich companies.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Guest Posts · Mergers and Acquisitions · Metro fiber

Nice piece James. Did you have to bring up the part about the wallet?

You say “Competitive tension is always good for a sale process and something you typically trade away only for a truly pre-emptive transaction value”. As a non-banker, I find this statement as biased. Sometimes sales auction processes produce the best result. Sometimes they don’t. A few processes FAILED to produce a sale. In some cases, the properties were traded in the frustrating aftermath of a FAILED processes. In all cases, an auction is highly disruptive to a business…and organic momentum is sacrificed. A lot of hidden costs are incurred during an auction.

A company should consider the pros and cons of an auction process. A company should know that the perspective of a banker will almost always be to run a structured auction process–and they will tend to emphasize the positive attributes while underplaying the negatives. Bankers know that once an auction is started, the probability of a trade in the subsequent 12 months is high–and since bankers get paid if a trade occurs, getting the mandate for an auction puts them on a path to a payday.

A bird in the hand is often worth two in the bush. The ability of a buyer to do a transaction can change abruptly due to debt markets or equity availability. A buyer could also move a different direction (e.g., buying a different property) while an auction process is played out. If you count on the interested party to be there while you delay decision making, you could be disappointed.

Great post.

Hope to get a chance to read you again in the future.

Thanks for the comment, Dan. (Sorry, but I couldn’t help myself on the wallet anecdote.)

Based on our experience, it’s rare to see a prospective buyer put their best foot forward in an acquisition process unless there is some type of competitive dynamic involved. A buyer will occasionally put forth a number designed to preempt a process or head off any prospect of a competitive dynamic, but again that tends to be an unusual occurrence. Simply put, when two or more parties truly want an asset and go head-to-head in a formal competitive process, it can yield remarkable results.

Yes, a sale process requires a major commitment of time and resources on the part of the seller and has the potential to be disruptive in a number of ways. To us, those factors underscore the logic of a formal process designed to test the market with all potential interested parties in a defined period of time. They also highlight the importance of having the assistance of outside professionals (i.e., investment bankers and legal counsel) who can bring to bear their transactional experience and execution resources to assist the owners and managers of a company in successfully navigating the complexities of a deal.

There are clearly potential risks involved in any sale of a company whether it’s in a broad auction process, a targeted solicitation or an exclusively negotiated transaction. It’s critically important for a seller to maintain financial and operational momentum during the course of a sale process. Likewise it’s important for a seller to have valuation expectations that are grounded in reality. The deals that we have seen fall short of the mark have typically suffered from one or both of those issues. Exogenous risks from the equity or debt markets can also be unpredictable factors as we all saw last fall.

As the margins get increasingly squeezed in the wholesale business, we are going to see more consolidations in the space. Scale is absolute power in this space as it means the lowest cost base. In that sense, the price paid by Zayo to acquire AboveNet will prove to be quite reasonable.

Rob, Is zayo rewriting the software of the acquired firms and going to one common platform for all of the companies?

toddforthree, while I don’t know their plans with Abovenet, yes Zayo has been moving everything to a unified platform with each acquisition. The speed of that integration is something they have justifiably been proud of. Of course, it’s also been an easier job than for, say, Level 3’s integration tasks, due to the more narrow product sets involved. AboveNet will be Zayo’s most difficult integration challenge thus far.

When it comes to being private, Level 3 is transparent and puts its cards on the table with a big fat WEB wallet. The word PRIVATE (deals) rings loud and clear over & over in this message.

Privately held Zayo Group LLC agreed to buy rival AboveNet Inc.

Bank Street is a private investment banking firm.

O.Mason Hawkins doing a first time private placement with Level 3 Communications.

Level (3) Private Line Services. It all boils down to – Moving data is serious business.

http://www.level3.com/en/products-and-services/data-and-internet/private-line-services/?p=1

*******************************************

James Henry says:

March 26, 2012 at 5:11 pm

Thanks for the comment, Dan. (Sorry, but I couldn’t help myself on the wallet anecdote.)

Based on our experience, it’s rare to see a prospective buyer put their best foot forward in an acquisition process unless there is some type of competitive dynamic involved. A buyer will occasionally put forth a number designed to preempt a process or head off any prospect of a competitive dynamic, but again that tends to be an unusual occurrence. Simply put, when two or more parties truly want an asset and go head-to-head in a formal competitive process, it can yield remarkable results.

Yes, a sale process requires a major commitment of time and resources on the part of the seller and has the potential to be disruptive in a number of ways. To us, those factors underscore the logic of a formal process designed to test the market with all potential interested parties in a defined period of time. They also highlight the importance of having the assistance of outside professionals (i.e., investment bankers and legal counsel) who can bring to bear their transactional experience and execution resources to assist the owners and managers of a company in successfully navigating the complexities of a deal.

There are clearly potential risks involved in any sale of a company whether it’s in a broad auction process, a targeted solicitation or an exclusively negotiated transaction. It’s critically important for a seller to maintain financial and operational momentum during the course of a sale process. Likewise it’s important for a seller to have valuation expectations that are grounded in reality. The deals that we have seen fall short of the mark have typically suffered from one or both of those issues. Exogenous risks from the equity or debt markets can also be unpredictable factors as we all saw last fall.

http://www.telecomramblings.com/2012/03/bank-street-perspective-on-the-abovenet-zayo-deal/#comment-7563

*******************************************

James H. Henry

Senior Managing Director

jhenry@bankstreet.com

Mr. Henry has been actively involved in the internet and telecom industry for more than a decade. His extensive and multi-disciplined knowledge of the industry is the product of his roles as an equity research analyst following the telecom and internet services sectors, as a portfolio manager responsible for investing in the telecom and media sectors, and as an investment banker executing capital markets and strategic transactions. Mr. Henry co-founded Bank Street Holdings LLC and has been a driving force in the growth and development of an investment banking practice that now has more than 20 senior investment banking professionals. Prior to Bank Street, Mr. Henry was a Senior Managing Director at Bear, Stearns & Co. Inc. where he served as the senior research analyst responsible for following the telecommunications and internet service and infrastructure sectors. Mr. Henry led a team of 5 dedicated associates and he was named the youngest Senior Managing Director in the history of Bear Stearns in 1999. Mr. Henry’s work and industry expertise has been broadly recognized. He was ranked 2nd by Institutional Investor Magazine’s All American Research Team Survey in 1999 and 2000. Mr. Henry has spoken at major telecom industry conferences, testified before Congress on telecom industry matters, and been quoted in national publications such as Business Week and The Wall Street Journal. Mr. Henry has a Bachelor of Arts Degree in Psychology from Connecticut College.

http://www.bankstreetgroup.com/TeamDetails.aspx?id=2

*******************************************

LONGLEAF PARTNERS FUNDS

SEMI-ANNUAL REPORT

at June 30,2002

Partners Fund – MANAGEMENT DISCUSSION

by Mason Hawkins, Staley Cates, and John Buford

After the close of the quarter, the Partners Fund, together with Berkshire

Hathaway, Legg Mason, and Longleaf Partners Small-Cap Fund, completed a

private placement in Level 3 convertible notes. Although typically we neither

own corporate bonds nor do private placements, this was a compelling opportunity

that the Fund’s flexible policies allowed us to pursue and that we did not

want to forego. The ten-year notes position Longleaf ahead of the common

equity, pay a 9% cash coupon, and are convertible at any time to common equity

at $3.41 per share – a price that is under the stock’s current level, and is far

below the company’s growing intrinsic value.

Level 3 owns the best fiber telecommunications network in the industry.

Importantly, most of its competitors struggle with huge debt levels and further

significant capital expenditure requirements. Many are now in bankruptcy.

Customers are universally worried about their service providers’ reliability,

financial integrity, and ability to provision future needs. Level 3’s superior

network infrastructure, its servicing capabilities, and its capital resources position

the company to become the clear industry winner. As we said in the press release

announcing the placement, We invested in Level 3 to take advantage of

consolidation opportunities in the telecommunications arena. We believe these

opportunities are substantial. Level 3 is uniquely and competitively positioned,

and its management team, led by Jim Crowe, is most able.

As Mr. Henry points out, the elephant in the room is Leverage. This deal does not work without substantial leverage. The new company will be levered at 5x EBITDA, which makes it one of the most highly levered companies in telecom. Many of their competitors are levered at 2x or 3x. Rates are historically low and not sustainable over the long run (recall the deal is priced at 9x EBITDA, implying 10 years to recoup capital).

Again, can anyone point to single, precedent transaction where a telecom/fiber/clec was bought in a successful LBO? In fact, each of Zayo and Above exist because past, unsuccessful attempts at leveraged telecom failed and investor capital was wiped out.

Back to Valmont’s LBO model, i am still waiting to understand how raising the cost of debt capital and the cost of equity capital and adding a “premium” somehow equals value creation ?

It’s quite a stretch to call this as a straight LBO. [1] Zayo is getting an outside equity investment to buttress its existing cash on-hand. [2] Zayo’s annual EBITDA was reported at $180.4M, hardly chump change.

The equity investment is already accounted for when you look at leverage ratios (debt/equity). and the EBITDA is already accounted for when you look at 5x EBITDA in post-closing leverage. The point remains, this is going to be a very highly leveraged telco. Abovenet was loved by customers due to their flex and willingness to invest. Newco will have investment parameters that look more like CBB, McLeod, XO (see thread) and the other current and dead highly leveraged telecoms.

Wall street pushed Abovenet to lever up and they wouldnt do it. Buyer showed up to do it (after paying a premium). At the end of the day, the cost of debt, cost of equity and enterprise value just went up. same biz, though…