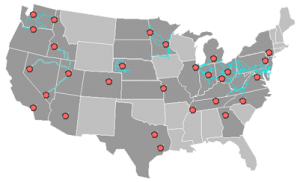

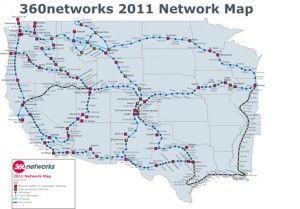

You knew it had been too quiet over at Zayo, I’m not sure they’ve ever gone a year without an acquisition. And so it came as little surprise today when Zayo announced the purchase of western regional operator 360Networks. In fact, the combination is one I mentioned as strategically interesting a few times in the past. Here are the two network maps side by side:

|

|

The 18,000 mile intercity fiber network of 360Networks will act to hook up most of Zayo’s more disconnected fiber assets across the western US. In fact, what this does is give Zayo a truly transcontinental presence, connecting to their eastern longhaul network at Chicago. Much of this fiber derives from the former Touch America buildout, and is rather unique. There is also dark fiber that 360Networks hasn’t lit yet connecting both Chicago and Dallas to New Orleans which I think Zayo will surely invest in lighting.

Additionally, 360Networks brings 800 miles of metro fiber of its own to the combination, which will add to Zayo’s coverage as well – giving the company a starter set in some new markets. Earlier this year, 360Networks did a deal with Zayo to leverage its metro dark fiber – so the two networks are already closely aligned.

All in all, this deal has always made sense for the strategic fit overall, and while there will be synergies I doubt very much if there will be substantial layoffs as a result. 360Networks also has a wholesale VoIP business, which will will be spun off by Zayo into Onvoy as in the past. Financial terms of the deal were not disclosed.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Mergers and Acquisitions · Metro fiber

Nice !

360N has had a book on the street for a while. Glad it ended up in the hands of a company (Z) that will do something good w/ the assets.

Would Telepacific now be in play for Zayo if they have the financing. That based on there recent alignment with 360 and the relationship as Zayo leaders sold those assets to Mpower/telepacific back in the ICG days. The growth in California and Texas would overlay very nicely along there new assets

looks like Rob had similar thoughts back when Telepacific announced deal with 360 suggesting they might purchase 360. Zayo beat them to the punch now will the combine making a very large clec

TelePacific recently announced the purchase of TelWest, giving them a footprint in Texas and suggesting their future will have an greater geographical focus. But California is a big state, and there are obviously opportunities for expansion there as well. Actually, given TelePacific’s Texas move, it is not that much of a stretch to envision them purchasing someone like 360Networks at some point to connect the two regions with fiber while expanding up the Pacific coast as well. I do suspect they are still hungry

While I do think both Zayo and Telepacific had good reasons to buy 360Networks, I’m not sure I agree that Zayo and Telepacific are now likely to find their own way to the altar. Zayo has shown no interest in the more traditional CLEC business, and Telepacific doesn’t really play in the pure fiber arena at all.

FWIW, I think Telepacific’s next move could be to make a play for Integra. Zayo’s is more likely to go after a Southeastern or New England fiber asset.

The last time we heard from Dan Caruso on this board, he was explaining his own business metric for determining the success of his ROI overtime, by rolling up fiber assets with what was considered “premium” ebitda multiple purchases.

He seems to have gone stealth since that period which I believe was prior to his AFS acquisition. Does anybody hear him talking about how his ROI has been faring in relationship to that metric?

At COMPTEL this week I believe Dan and the other infrastructure operators made it clear none of them have any interest in owning or operating a CLEC.

Off the topic of Zayo….

Brian, this is an interesting remark – thanks for mentioning it. Can you share additional details re who said what? I have been posting a similar thought on this board — with only one or two examples, I don’t see any particularly profitable, strong ROIC players in the CLEC space. With data “eating” the voice business (LD minutes, international), this strikes as a space to run away from. Several selling industry veterans appear to concur.

Thanks for the positive post and comments. Carl, we publish our financial data each quarter in grand detail. The metric you are referring to is Invested Capital Ratio. ICR = Total Investment that has gone into Zayo / Annualized EBITDA. The most recent quarter had this metric at ~4.2x. It is essentially our basis in the business, stated as a multiple of EBITDA. LVLT trades at about 9x. If you applied this multiple to Zayo, the difference between 9 and 4.2 is the gain our equity investors are enjoying.

Very nice summary, and thank you, Dan. I was also under the belief system that, between the ongoing management of the purchased assets, organic sales from their incorporation, and the potential for price increases at some point in the cycle, this ratio would continue moving towards par over time, or 1:1.

Would you be so kind to point out the quarterly or yearly trend during the past two years since synergizing some assets?

With this in mind, you are building privately what could become a very rich IPO for your owners’ invested capital one day.

I should have known you would cling to the Buffett Cloth, a man who is known to buy private assets for 4-5 PE’s, and fold them underneath his public umbrella for ten to fifteen P/E’s depending upon Mr. Market’s mood swing. 🙂

http://www.zayo.com/sites/default/files/ZG%20FY%204Q%202011%20Earnings%20Supplement%20FINAL.pdf

look on page 9 of this report… shows ICR for past 5 quarters… here is a quiz for the financially savvy members of Ramblings’ readership… if u assume Zayo was worth 9x EBITDA in each quarter, how much “new equity value” was created in each of the past 4 quarters? You can calculate this using only the data from page 9.

Dan Caruso, Thank you very much for opening your books to reveal the great numbers!

***if u assume Zayo was worth 9x EBITDA in each quarter, how much “new equity value” was created in each of the past 4 quarters?

Is the correct answer as follows:

September 30 December 31 March 31 June 30

$465.6 $526.2 $571.6 $753.6

That’s a lot of hidden Intrinsic Value being piled up!

Hi Dan-

If sold/IPO’d today it would net investors about 750 million at 9x Ebitda (after deducting previous contribution). Had Zayo sold in Q3 2010 investors would have netted about 465 million. So the net new is about 285 million in one year….nevermind that 10-12x Ebitda is fairly realistic given how financially sound Zayo is.

One questions though about annualizing Ebitda, it seems that the SOP is to multiply the current quarter out as if those gains can be expected all year. Isn’t simply looking at the previous 4 quarters more realistic?

Thank you.

I believe the reason for “annualizing” the last quarter’s results is that Zayo’s revenues generally stem from long-term contracts. Therefore, so long as each quarter’s sales exceed the lost value from churn during that same period (which is almost certain in Zayo’s case, I believe), EBITDA will grow from quarter to quarter. Because it would be difficult to accurately predict the magnitude of future EBITDA growth, however, Zayo appears to be taking a conservative approach by essentially treating its last quarter’s EBITA as continuing over the following 3 quarters. This produces a more “realistic” result than pretending that EBITDA will shrink to the level experienced over the preceding 12 months.

Nicely done. How would you go about estimating how much was created in EACH of the past 4 quarters? Use whatever EBITDA multiple you want to use for valuation purposes…I’m not suggesting what is the correct number. I just want the math to be illustrated. Paul’s explanation is a pretty good one on why “LQA” or “Last Quarter Annualized” might be a better metric for this purpose… it is a more current reflection on how a recurring revenue business is performing… Moreover, if you sum up last 4 quarters, the “value creation” might have been 3 quarters ago.

Dan, a few things. Why not round to the nearest one hundredth vs. tenth which would make the goal to par or negative–my dream for you–take a bit longer? Since your numbers as a private enterprise are still relatively small, this is somewhat “material” or a “red herring” from my perspective.

Specific to the footnote on June 30th, I only see $5.4MM in Member’s Interest “net” decreases, yet Member’s Interest was reduced by $11.8MM qoq. Why am I short $6.4MM with no acctg. explanation for this gap qoq?

If your numbers are golden inclusive of the annual trajectory being presented at the June 30, 2011 quarter end, your Member’s Interest would be realizing an additional $753.6MM in “new equity” with a 9X EBITDA multiple assuming the public marketplace were paying it, but I don’t see that they are.

I keep hearing that Wall Street in all of its omnipotence is intent on pegging 7 multiples today, but their math doesn’t add up when examining today’s combined Level 3 and Global Crossing quote($1.69) excluding synergies, and $1.27B EBITDA.

Right now, you and your members could buy the public company you once worked for, at a ridiculously low 4.11 EV/EBITDA MULTIPLE.

Fortunately for Jim Crowe, he decided to get off the NasCRACK, and assuming they don’t end up purchasing NYSE/EURONEXT, this shift should be more favorable in ascribing better “valuations” while attracting a more reasonable investor mindset to their enterprise.

Knowing what cheaters, cut throats as well as criminals reside in Wall Street suits, Dan, be happy that you remain a private company, and “be careful what you wish for.”

Dan, I should clarify a 9X “Invested Capital Ratio(ICR)” while your ICR is a somewhat mirror image of EV/EBITDA ratios.

ICR is Invested Capital / EBITDA, where Invested Capital is a tabulation of how much has been invested cumulatively in the business. It is the “basis” in the business, stated as a multiple of EBITDA.

Why does it matter? It allows a direct comparison to EV/EBITDA.

What might you call the delta between EV/EBITDA and Invested Capital Ratio?

The public market premium. Alternatively, the difference b/w the market value and cost of your equity as debt is the same whether expressed in EV or IC.

I see what you’re saying. Invested Capital is 9X EBITDA when I had calculated the “new equity” in addition to the existing equity at the lower multiple.

The delta between the two is an interesting question tied to the “rate of change” between one vs. the other.

Would it be the public “market multiple” being assigned to EV/EBITDA during various snapshots in time?

Be kind to me by satisfying my quandary over the “gap” I believe exists on the lower Member’s Interest for the June, 2011 quarter after accounting for the footnote.

This is an absolutely terrific thread for gaining additional understanding of the model. Thanks to everyone!

Apologies to Rob’s board. I made a mistake on (3)’s EV/EBITDA multiple last night.

http://www.investopedia.com/terms/e/enterprisevalue.asp#axzz1aOgeBP8z

It currently stands with 10.53 multiple utilizing their low ball 1.27B non synergy EBITDA numbers as follows:

1.75 pps*3.1B shares outstanding=$5.425B

$5.425B + $7.5B net debt=$12.925B

$12.925B/$1.27B EBITDA=10.53 multiple

Dan seems to be doing a fine job creating “value” in the private sector except that anyone paying him a nine may not have the necessary “margin of safety” for when things go wry in the marketplace according to more “dear” projections as being sustainable and forward garnering.

I would still like to hear an accounting explanation for reconciling the gap I see on Dan’s June, 2011 reduction in Member’s Interest including the footnote.

Hey Carl. The accounting explanation is as follows:

The $11.8M is before discontinued operations are excluded. If you focus on the row that is titled “Member’s Interest Excluding Discontinued Operations”, you will see the $5.4M footnote is a complete explanation.

The historical EBITDA on the slide also excludes Discontinued Operations. As such, we netted out the corresponding Member’s Interest. This allows us to keep track of how much investment is associated with ZGL.

Now in english. Zayo Group LLC is a Bandwidth Infrastructure company. We had a small amount of revenue that was Managed Services e.g., retail VoIP, converged T1s, and web hosting. We thought it best to spin MCS out of ZGL. Revenue, Ebitda, and the corresponding Member’s Interest (or investment) was spun out of ZGL. The financials provide financial transparency so our debt holders can understand the financials associated with the spinout.

make sense?

Yes, Dan, and thank you. I like your plain spoken English also.

So, if a Member’s Interest was reduced by being bought out or any other reason for being reimbursed their original capital, the investment capital “basis” or Member’s Interest would not be reduced at the same time, is that correct?

Dan, should a member reduce his or her basis by having his “investment capital” returned, cash would be reduced, but should “investment capital” be reduced also? I would hope not.

Member’s Interest is a tabulation of basis, not value. Hence, we would reduce Member’s Interest when we dividend out cash (or other value) to our Member’s.

Example: If Members invested $100M in year 1 and received a $10M dividend in year 3, the remaining basis in the business is $90M.

Make sense.

This part does not make sense in my feeble mind because, the investment capital supplied by “Member’s interest” inside their “cost basis,” remains in the business even if the cash generating mechanisms being produced by the assets of the business from prior “investment capital” are being returned to their owners. The definition seems to imply a tabulation or a compendium of “investment capital” that is ongoing while leading up to producing cash and profits from DAY 1. Just because cash and profits are returned to owners, the investment capital in the business has not changed, except for the need to add or invest in existing assets according to “depreciation.”

@ Carlk…. your original question was “should a member reduce his or her basis by having his “investment capital” returned?” This implies that the cash that the investor receives is a “return of capital” rather than a “return of profits”. To the extent that a company has a retained earnings balance any cash dividends are accounted for by that company as a dividend or a return of profits to investors and the company would reduce their retained earnings balance not their APIC (or in Zayo’s case members interest). If the Company does not have a retained earnings balance but rather an accumulated deficit, cash payments to investors would be accounted for as a “return of capital” which would not be taxable to the investor and would be accounted for as a reduction to APIC/members interest by the Co. That’s the GAAP accounting from a companies perspective. If you have a Company that was formed with $100,000 in cash from 10 investors (lets assume $10,000 from each investor) and two years down the road that Company is worth $150,000. An individual investors basis is $10,000 in the Company but the FMV of his/her investment is $15,000. Lets assume one of the investors needs to pull out $5,000, regardless or whether or not the Company had a GAAP retained earnings balance, that investor would reduce his basis. Though, I think were you’re getting confused is by how much the basis would be reduced (from an investor perspective) and the answer is it wouldn’t be reduced by $5,000. Rather, the other investors would have to agree upon a valuation of the Company on the distribution date – in this case lets assume they all agreed the valuation was $150,000. The investor to receive the distribution had an original basis of 10% (i.e $10,000/$100,000) and the fair value of his investment before the distribution is $15,000 (i.e. 10% x $150,000). After the $5,000 distribution the fair value of his investment (not basis) is reduced by $5,000 to $10,000 and his new ownership percentage is 6.6% ($10,000/$150,000). Not sure if that clarifies?