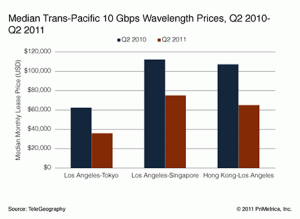

According to a report out this morning over at Telegeography, transpacific wavelength pricing pressure has been very substantial over the past twelve and twenty four months. Between Q2 2009 and Q2 2011 the median monthly lease price for a 10G wave between LA and Tokyo has fallen from $98,500 to $36,000. Pricing on other routes routes has fallen similarly, with twelve month declines of 33% and 39% for LA-HK and LA-Singapore, respectively.

But honestly, we all knew this was going to happen, right? After all, pricing is still well above transatlantic wavelength pricing, moreso than is justified by the longer distances. Three new high capacity transpacific cables have come online, one in each of the last three years: TPE, AAG, and Unity. How could pricing do anything else?

But honestly, we all knew this was going to happen, right? After all, pricing is still well above transatlantic wavelength pricing, moreso than is justified by the longer distances. Three new high capacity transpacific cables have come online, one in each of the last three years: TPE, AAG, and Unity. How could pricing do anything else?

The undersea bandwidth market tends toward this painful cycle – high up front costs, then more bandwidth than you need for many years, falling prices that may or not match your assumptions, and then just when things get sane you have to do it again. While Pacific Fibre may get built, adding capacity to and from New Zealand and Australia, the transpacific pricing pressures we are seeing now suggest we will see a break in construction for a number of years. That is, unless the low latency, high speed trading phenomenon doesn’t stir things up like it is in the Atlantic.

Africa, with an even larger relative surge in cable construction of late, will probably also see huge pricing declines. It’s a bit of a paradox though. They *want* pricing declines in order to kick start internet development, but on the other hand the more of it they get the less financially justifiable those internet development plans become for those who will actually implement them.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Undersea cables

Discuss this Post