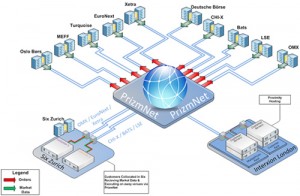

Back in February there was a report that pan-European network operator Colt Group (LON:COLT, news) was eyeing MarketPrizm with an eye toward a greater presence in the financial vertical. Well it took a few months but such a deal did in fact take place, as yesterday Colt announced a binding agreement to purchase a majority stake in MarketPrizm, whose current owner Chi-X Global will stay on as a minority shareholder via its Instinet subsidiary. Colt hopes to leverage MarketPrizm’s financial data offerings and trading infrastructure as well as its own portfolio of low latency connectivity and proximity hosting to take a bigger slice of the financial vertical pie in Europe.

MarketPrizm operates some 5500km of dark fiber between the major trading venues of London, Paris, Frankfurt and Amsterdam, which it connects with Infinera PICs and Juniper switches. That sort of infrastructure is something that Colt can certainly help with, not to mention expand to additional key sites across Europe.

MarketPrizm operates some 5500km of dark fiber between the major trading venues of London, Paris, Frankfurt and Amsterdam, which it connects with Infinera PICs and Juniper switches. That sort of infrastructure is something that Colt can certainly help with, not to mention expand to additional key sites across Europe.

As part of the deal, Colt will fund the next phase of MarketPrism’s growth. That and acquisition costs are expected to eat a small €10M hole in their EBITDA for the remainder of 2011. I do wonder why Colt didn’t buy the company outright, but perhaps it’s best to keep the financial expertise in-house. Another question is whether this sort of idea will catch on with other network operators targeting the low latency trading sector, whether in Europe or the USA or both.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Internet Backbones · Low Latency · Mergers and Acquisitions

Discuss this Post