Well, you heard it here first if only by a few hours. Zayo Group has announced an agreement to purchase Rochester-based American Fiber Systems. The deal will be Zayo’s 15th acquisition since its 2007 inception, and the second so far in 2010. Financial terms were not disclosed but the Rochester Business Journal pegs the price at $185-190M. [EDIT: Further information says this range is too high!] I’m still looking for a datapoint somewhere to figure out what EBITDA multiple they might have paid, but haven’t found one yet. I fully expected Zayo would be making another move soon, but I actually didn’t think it likely that they would go after AFS until hearing about it last night.

Well, you heard it here first if only by a few hours. Zayo Group has announced an agreement to purchase Rochester-based American Fiber Systems. The deal will be Zayo’s 15th acquisition since its 2007 inception, and the second so far in 2010. Financial terms were not disclosed but the Rochester Business Journal pegs the price at $185-190M. [EDIT: Further information says this range is too high!] I’m still looking for a datapoint somewhere to figure out what EBITDA multiple they might have paid, but haven’t found one yet. I fully expected Zayo would be making another move soon, but I actually didn’t think it likely that they would go after AFS until hearing about it last night.

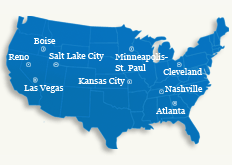

So what does Zayo get for its money? A pure metro fiber business covering 9 markets with roughly 1200 route miles of fiber. That fiber connects (at last count) some 627 buildings, mostly wholesale and larger enterprise sites. Two of those markets add substantial depth to Zayo’s existing footprint: Cleveland and Minneapolis. One, Atlanta, dovetails very nicely with Zayo’s other pending purchase of AGL Networks. Four related markets in the mountain west fill in the map between Zayo’s Colorado and Washington markets: Boise, Salt Lake City, Reno, and Las Vegas. And of the other two, Nashville fits nicely with Zayo’s Memphis market, while Kansas City gives them a foothold in the lower plains. AFS’s share of US Carrier’s regional fiber throughout Georgia will also fit well with Zayo’s other regional fiber holdings.

So what’s left to be fleshed out on Zayo’s map? Looks like New England, Florida, and more in California and Texas. Hmmm, Texas… Alpheus perhaps?

So what’s left to be fleshed out on Zayo’s map? Looks like New England, Florida, and more in California and Texas. Hmmm, Texas… Alpheus perhaps?

American Fiber Systems CEO Dave Rusin has long been a blogging neighbor and frequent commenter on Telecom Ramblings, perhaps this will free him up even further to continue his industry commentary.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Mergers and Acquisitions · Metro fiber

i think this is great news, in that consolidation and scale tend to drive efficiency and will allow Zayo to be a more relevant competitor in these markets, many of which don’t really have an “alternative/hicap/metro” data carrier in place to compete with ILEC.

However, I am concerned to see Zayo emerge as the only buyer/consolidator of these metro assets. Clearly Above, TW, L3 and others (including RLECS, Private Equity and maybe even RBOC/PTT’s) are looking at all of these assets and getting out bid by Zayo.

So…. Drum Roll….. Are the Zayo guys “ahead of the curve” and snatching up attractive investments, or simply over-paying. Tons of stories in Telco of consolidators paying up to consolidate and never realizing synergies. (as we all know, a few have been WSJ front page debacles (e.g., WorldCom). On the other hand, a few (mostly cable MSO’s) have build impressive franchises. (also, no comment on which bucket Level3 is best placed in….).

Rob- any thoughts???

I would say simply that Zayo is the most aggressive, whereas most of the others are opportunistic. For AGL and AFS, I would say that the other most likely bidder by far) for these assets would have been Abovenet, but they simply don’t want it as much – yet.

FWIW, I believe that there are enough properties available right now that we will see others make moves in time. Particularly TW Telecom, which of the public companies is probably the best positioned to make a move.

Lets not forget that Caruso resold ICG for a premium…while I certainly believe Dan is building a solid company for the long term and believe they integrate very effectively everyone has their price….

meaning that if offered the right amount Zayo itself could be setting up themselves to be aquired down the road….by you know someone like….

TW Telecom…;-)

Caruso did sell ICG for a premium back in the heyday but those days are gone. Caruson and his Zayo teams reputation for running a strong business are unquestioned. However, Zayo seems to be the high bidder (some say overpaying) for most if not all the properties they’ve acquired. Their big bet and value to the wholesale markets is constructing Fiber To The Tower. But how much incremental growth is at those locations? Sure towers will convert from TDM to Ethernet but the mobile carriers will leverage lower traditional price points for Ethernet going forward and pit Zayo against the incumbent. Obviously while the cell carriers implement Ethernet they will be decreasing and dropping T-1’s making uplift revenue potential gains minimal. Along with that compression, MPLS and caching technologies continuing their advance, cell carriers need for larger bandwidth to the tower will be further reduced. Could it be Zayo does not want to flip it anytime soon or are not concerned with that possibility? Maybe I’m missing something here and welcome enlightenment.

interesting. thank you both for the reply.

does anyone have a sense for replacement cost vs purchase price on these assets? dollar per mile? i know for a fact that agl built the majority of their network, post crash, with directional bores which are much less costly than open trenches).

“Directional bores much less costly than open trench”. That doesn’t match up with any construction pricing that we have seen, although it is hard to generalize due to variations in project conditions. You might save in cleanup and/or restoration but per foot pricing of placement?

My jury is still out on the Fiber to the tower, but looking at Allied FIbers biz case would be enough to suggest, that all thsoe guys building to the towers, better be a little more careful…If Allied get’s into bed with American Tower, etc that could really be an issue down the road. Build a 48-96ct lateral or even dual entry into the tower and then allow the incumbent’s who rent from American Tower light their own backhaul…..that could ruin someone down the road

In all these recent deals I see the strategic competitor outbidding the PE guys (notable exception is RCN/Abry but that doesn’t really count since RCN is really a cable company that happens to have a Fiber company under its wing).

Anyone else hear the rumor that a Zayo / RCN Metro deal might be in the works once Abry closes on RCN? Would be a sweat deal for everyone (except maybe RCN Cable) and the PE deal makers of Abry, and Zayo’s M/C, Battery and Charlesbank are all right down the street from each other not too mention they are buddy-buddy with each other. Despite Abry being left only with a crappy cable company they’d get an immediate return esp. with multiples through the roof right now and can hold the cable asset for a while as anything additional down the road would just be gravy (and perhaps the cable systems/subs would be of interest to TW Cable in the 3-5 year future).

Remember that there are PE guys behind Zayo and Lightower as well. I think it’s a given that the PE money that already has metro fiber has an advantageous position in acquiring more of it. But it’s not just ABRY, there is also the Dukenet deal. Other PE wants in.

As for a Zayo/RCN deal down the line, I have no doubt at all that Zayo would like to get its hands on RCN Metro’s fiber if the price were right. But ABRY’s intentions are not yet clear. I really don’t put it past them to turn around and buy Fibertech or NSTAR or even Intellifiber to go with it. It all depends on what they want to do.