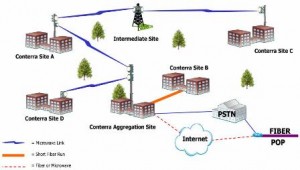

In this profile, Telecom Ramblings looks at the wireless backhaul provider Conterra Telecom Services. I have traditionally been partial toward fiberoptic networks of course, but fiber does have its imitations and I am rapidly becoming interested in hybrid fiber/wireless networks. When you get outside the main metro loops yet still need more bandwidth than copper can ever offer, that’s where providers like Conterra step in to fill the gap. They design, build, and operate the wireless middle mile and last mile links of hybrid fiber-wireless metro networks, with over 6000 path miles and 54,000 T-1 equivalents in service – numbers that have been growing quickly. They are privately held and operating cash-flow positive, with backing from big money such GE Capital and Dukenet – the latest round of funding was for $41M in 2007. Conterra has two main customer segments, E-rate and Mobile Carrier, both of which they serve from a wholesale perspective.

In this profile, Telecom Ramblings looks at the wireless backhaul provider Conterra Telecom Services. I have traditionally been partial toward fiberoptic networks of course, but fiber does have its imitations and I am rapidly becoming interested in hybrid fiber/wireless networks. When you get outside the main metro loops yet still need more bandwidth than copper can ever offer, that’s where providers like Conterra step in to fill the gap. They design, build, and operate the wireless middle mile and last mile links of hybrid fiber-wireless metro networks, with over 6000 path miles and 54,000 T-1 equivalents in service – numbers that have been growing quickly. They are privately held and operating cash-flow positive, with backing from big money such GE Capital and Dukenet – the latest round of funding was for $41M in 2007. Conterra has two main customer segments, E-rate and Mobile Carrier, both of which they serve from a wholesale perspective.

The first segment, E-rate, consists of supplying bandwidth to schools and local governments beyond the range of fiber rings. This segment has been growing rapidly; Conterra now serves over 1000 K-12 schools across the country. These are government contracts that are supported by those USF fees we all pay on our phone bills. Each year Conterra bids on the ones that they can serve economically, but they can be anywhere in the country. Unlike a fiber backbone which must always think of extending from one node to the next and thus grows along connected pathways, Conterra’s territory spans isolated communities in some 16 states from coast to coast but with little in between. Each E-rate market must therefore stand on its own, establishing a self sufficient foothold for future expansion.

The first segment, E-rate, consists of supplying bandwidth to schools and local governments beyond the range of fiber rings. This segment has been growing rapidly; Conterra now serves over 1000 K-12 schools across the country. These are government contracts that are supported by those USF fees we all pay on our phone bills. Each year Conterra bids on the ones that they can serve economically, but they can be anywhere in the country. Unlike a fiber backbone which must always think of extending from one node to the next and thus grows along connected pathways, Conterra’s territory spans isolated communities in some 16 states from coast to coast but with little in between. Each E-rate market must therefore stand on its own, establishing a self sufficient foothold for future expansion.

The second segment is wireless backhaul for mobile carriers. We have been hearing for years that wireless carriers have little choice but to upgrade their backhaul systems for the coming wave of data. That will of course mean fiber to many towers, but there will always be many towers which will never have fiber connecting them but for whom copper just won’t do. It is that periphery where Conterra intends to make its mark. But they prefer to work with the fiber providers in an area such as a TW Telecom or Level 3, rather than try to do everything. This allows them to raise capital for only the parts they are best at, while the fiber carriers can do the same. That fiber and wireless may compete for some cases does not change the fact that they are both needed to accomplish the overall job in next generation backhaul networks. With the promised 4G download speeds, copper will eventually be insufficient for virtually all cell sites.

The migration of US mobile carriers to the next generation of backhaul systems has, of course, taken much longer than many expected. But unlike some of the competition Conterra has anticipated and planned for these inevitable delays by pushing its E-rate business first, thus allowing them to expand geographically and financially without waiting for the mobile carriers to finally do what seems inevitable. That leaves Conterra very well positioned as we enter this new economic phase where capital isn’t so cheap anymore yet traffic growth is unlikely to slacken.

In part 2 of this article, we hear directly from Stephen Leeolou, CEO and Chairman of Conterra about their business, the economy, the stimulus, and more.

If you haven't already, please take our Reader Survey! Just 3 questions to help us better understand who is reading Telecom Ramblings so we can serve you better!

Categories: Industry Spotlight · Wireless

Looks like Court Square (of Fibertech fame) just bought Conterra.. Any details?